No credit check bank account no deposit opens doors for those previously shut out of traditional banking. This guide delves into the intricacies of these accounts, revealing their features, application processes, and potential pitfalls. We’ll explore the diverse options available, from prepaid cards to virtual accounts, providing a comprehensive overview for anyone seeking a financial solution that doesn’t require a perfect credit score.

Imagine a world where banking isn’t gatekept by credit scores. This is the promise of no credit check accounts. But before you rush in, let’s dissect the nuances of these accounts, weighing the benefits against the risks.

Understanding the Concept

No credit check bank accounts and no deposit accounts offer a streamlined alternative to traditional banking for individuals seeking a more accessible financial solution. These accounts often cater to those with limited or no credit history, those who prefer digital banking, or those seeking a simple way to manage funds. They present a unique set of features and benefits, contrasting with traditional accounts, and understanding these differences is key to choosing the right account.These accounts often prioritize ease of use and accessibility over traditional banking’s comprehensive suite of services.

This approach makes them appealing to a specific demographic, but it also comes with potential drawbacks that are important to consider. Understanding the various types, advantages, and disadvantages is critical to making an informed decision.

No Credit Check Bank Accounts

These accounts are designed for individuals who may not have a credit history or whose credit history is less than ideal. They typically require less stringent credit checks than traditional bank accounts, enabling a wider range of individuals to open an account. These accounts may be an excellent entry point into the formal financial system for those previously excluded.

No Deposit Accounts

No deposit accounts are a convenient way to manage funds without needing to deposit a significant amount upfront. This is often appealing to users who want to test the account’s services or features before making a substantial financial commitment.

Features and Benefits

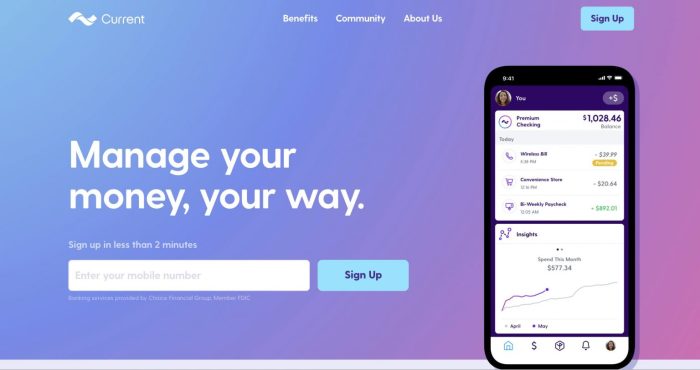

No credit check and no deposit accounts often boast straightforward onboarding processes. These accounts usually emphasize simplicity, often with a streamlined digital interface. They frequently offer mobile deposit options and budgeting tools, which can be beneficial for managing finances effectively. Many offer free or low-cost transaction services, which can save users money on typical banking fees.

Comparison with Traditional Bank Accounts

Traditional bank accounts typically require a credit check, and often involve a minimum deposit amount. They frequently come with a wider array of services, including investment options, loan facilities, and potentially, higher transaction limits. No credit check and no deposit accounts, in contrast, often focus on basic transactional needs. Their limited features can be a trade-off for their accessibility.

The choice between a traditional and a no credit check account depends on the individual’s specific financial needs and circumstances.

Types of No Credit Check Bank Accounts

Different types of no credit check accounts cater to varying needs. Prepaid accounts allow users to load funds onto a card and spend them without incurring debt, offering a useful tool for budgeting. Virtual accounts often operate solely online, facilitating a completely digital banking experience. Each type has its advantages and disadvantages.

Advantages for Customers

The primary advantage of no credit check and no deposit accounts is accessibility. These accounts provide an opportunity for those with limited credit history or resources to gain access to basic banking services. Their user-friendly design and ease of use are further attractive elements. The low barrier to entry makes them a viable choice for those new to financial institutions.

Disadvantages for Customers

These accounts often have limited services and features. Their transaction limits might be lower than those of traditional bank accounts, and they may not offer the same range of investment options. The potential for higher fees or restrictions on specific services should be considered. Furthermore, their reputation and reliability might not be as well established as traditional banks.

Account Application Processes

Opening a no-credit-check bank account often involves a streamlined application process, tailored to verify your identity and address without relying on traditional credit checks. This approach often involves alternative forms of verification, designed to assess your financial responsibility and suitability for the account. These procedures are critical for the bank to assess risk and ensure responsible account management.The application process for no-credit-check bank accounts is designed to be efficient, although it often differs from traditional bank account applications.

The specific requirements and verification methods can vary between different providers, reflecting their unique risk assessment strategies. This section details the typical steps involved, the documents commonly required, and the verification methods employed by various providers.

Steps Involved in Opening a No Credit Check Bank Account

The application process for a no-credit-check bank account typically begins with an online application form. This form often requests personal information, including your name, address, phone number, and email address. Following the online application, you’ll be required to submit the necessary documentation. After verifying the submitted documents, the bank will either approve or reject your application. If approved, you may be required to complete additional steps, such as setting up online banking or activating your account.

Documentation Typically Required

To open a no-credit-check bank account, you will likely need to provide identification and proof of address. Common documents include a government-issued photo ID, such as a driver’s license or passport, and proof of residency, such as a utility bill, lease agreement, or bank statement. The specific requirements can vary among providers, and some may accept alternative forms of proof, such as pay stubs or recent tax returns, particularly in situations where a utility bill is not readily available.

Verification Methods Used by Different Providers

Banks utilize various methods to verify the information you provide during the application process. These methods can include identity verification, address confirmation, and sometimes, additional checks, such as employment verification or income verification, to assess the applicant’s financial responsibility. The level of verification required can depend on the specific provider and their risk assessment strategy.

Table Demonstrating Differences in Application Processes

| Provider | Required Documents | Verification Methods |

|---|---|---|

| Example 1 | Government-issued photo ID (e.g., driver’s license), recent utility bill (e.g., electricity or gas bill), and proof of social security number | Automated ID verification using official databases, address verification using utility company databases, and possibly a phone call to confirm address. |

| Example 2 | Government-issued photo ID (e.g., passport), a recent bank statement showing address, and a recent pay stub. | Automated ID verification using official databases, bank statement address verification, and a phone call to confirm employment. |

Alternative Verification Methods for Specific Situations

In certain situations, alternative verification methods might be necessary. For instance, if you are a recent immigrant or a student without a traditional utility bill, a recent lease agreement or a letter from your university might suffice as proof of address. Similarly, if you are self-employed, pay stubs or tax returns might be accepted as proof of income.

The specific alternative methods accepted will vary between providers, so it is essential to check with the bank or financial institution directly.

Account Features and Functionality

No credit check bank accounts, while offering a streamlined application process, are not a one-size-fits-all solution. Their features and functionalities vary considerably depending on the specific provider. Understanding these differences is crucial for selecting the account that best suits your needs. These accounts typically prioritize accessibility and ease of use over extensive financial services.

Transaction Limits and Fees

Transaction limits and fees are key factors to consider when evaluating no credit check accounts. These accounts often impose restrictions on daily transaction amounts, monthly withdrawal limits, and the number of transactions permitted. Fees can also vary significantly, covering activities like overdraft protection, ATM usage, or insufficient funds.

- Daily Transaction Limits: Many no credit check accounts set daily transaction limits, preventing users from exceeding a specified amount in a single day. This safeguard helps to protect against unauthorized activity and maintain account stability. For example, a user might be limited to $500 in withdrawals or $1000 in total transactions daily.

- Monthly Withdrawal Limits: Similar to daily limits, monthly withdrawal limits prevent excessive withdrawals. This helps manage the account’s financial health and avoid exceeding a predetermined monthly expenditure. A typical example would be a monthly withdrawal limit of $2,000.

- Fees: No credit check accounts often have fees for services like overdraft protection, ATM usage outside the network, or insufficient funds. Carefully review the fee structure to understand the potential costs associated with using the account. A common fee is a monthly maintenance fee or a fee for insufficient funds.

Debit Cards and ATM Access

The availability of debit cards and ATM access is another critical aspect of no credit check accounts. A debit card allows users to make purchases and withdraw cash, while ATM access provides convenient locations for handling transactions. The types of cards and the networks they’re affiliated with will affect transaction fees.

- Debit Cards: Most no credit check accounts come with debit cards, allowing users to access their funds and make payments at various merchants. The debit cards often operate on a particular network, and this influences transaction fees. The card’s design and branding might differ between providers.

- ATM Access: The extent of ATM access varies among providers. Some accounts might have a limited network of partner ATMs, while others offer broader access to ATMs nationwide. This means that users should understand the network coverage to determine ATM availability.

Mobile Banking and Online Access

Mobile banking and online access provide a convenient way to manage no credit check accounts. Features like account balance inquiries, transaction history reviews, and bill payments can be performed through these platforms. The degree of functionality and the security measures employed by each provider vary.

- Mobile Banking: Mobile banking apps provide access to key account features, such as viewing balances, transferring funds, and paying bills directly from a smartphone. Users can access account information anytime, anywhere, through their mobile devices.

- Online Access: Online portals allow users to perform similar functions as mobile banking, but on a computer. Online access offers a wider range of features and control over account activities. Security measures, such as two-factor authentication, often accompany these platforms.

Feature Comparison Table

| Provider | Daily Transaction Limit | Monthly Withdrawal Limit | ATM Access Network | Mobile Banking | Online Access |

|---|---|---|---|---|---|

| Provider A | $500 | $2,000 | Visa/Mastercard | Yes (iOS/Android) | Yes |

| Provider B | $750 | $3,000 | Mastercard | Yes (Android) | Yes |

| Provider C | $1000 | $5,000 | Visa/Mastercard/AMEX | Yes (iOS/Android) | Yes (Desktop/Mobile) |

Risks and Considerations: No Credit Check Bank Account No Deposit

Navigating the world of no-credit-check, no-deposit bank accounts necessitates a keen understanding of potential pitfalls. These accounts, while offering accessibility to some, often come with trade-offs in terms of security, features, and overall financial prudence. A thorough evaluation of potential risks is crucial before committing to such an account.Thorough scrutiny of the risks and considerations surrounding these accounts is paramount.

The allure of easy access can mask inherent limitations and potential downsides. Understanding the nuances of these accounts is essential for making informed decisions that align with personal financial goals.

Unburden yourself from financial constraints with a no credit check bank account no deposit, a gateway to limitless potential. Embrace the freedom of financial independence, a path that mirrors the unfettered spirit of acquiring rare items like a Fortnite Candy Axe for sale. fortnite candy axe for sale Unlocking this digital treasure, like opening a new account, reveals the inherent abundance within you, a profound truth mirrored in the universe’s boundless generosity.

This liberating financial choice is a testament to the limitless potential within you, just like the no credit check bank account no deposit.

Potential Security Concerns

These accounts, often designed for rapid onboarding, may not have the same robust security protocols as traditional banking systems. Compromised accounts can lead to significant financial losses. It’s important to research the security measures employed by the specific provider. For instance, consider whether the provider utilizes multi-factor authentication, employs encryption technologies, or has a history of successful security measures.

Terms and Conditions

Carefully reviewing the terms and conditions is critical. Hidden fees, usage limitations, and stipulations on withdrawal limits can significantly impact the account’s practical value. The terms and conditions Artikel the provider’s expectations and rights, and the user’s responsibilities and restrictions. Failing to understand these clauses could lead to unforeseen charges or account restrictions.

Limitations and Restrictions

No-credit-check, no-deposit accounts frequently come with limitations. Daily transaction limits, withdrawal restrictions, and inconvenient transfer procedures can make these accounts unsuitable for certain financial needs. For example, some providers may impose daily transaction limits or restrictions on the frequency of withdrawals, which could be problematic for individuals with high-volume transactions. Thorough understanding of these constraints is critical to avoiding potential inconveniences or surprises.

Comparison of Provider Risk Profiles

Different providers exhibit varying risk profiles. A provider with a history of rapid account closures or negative customer reviews should raise red flags. Providers who prioritize customer support and transparency generally present a lower risk profile. It’s prudent to research and compare multiple providers to assess their reliability, reputation, and security measures. A table summarizing risk profiles can be helpful.

For example, consider the following comparison:

| Provider | Security Measures | Customer Reviews | Risk Profile |

|---|---|---|---|

| Provider A | Strong encryption, multi-factor authentication | Positive, reliable | Low |

| Provider B | Limited security measures | Mixed, some negative | Medium |

| Provider C | Unknown security measures | Negative, frequent complaints | High |

These risk factors highlight the importance of diligent research and careful consideration when choosing a no-credit-check, no-deposit bank account.

Customer Experiences and Reviews

Customer experiences with no credit check bank accounts paint a varied picture, reflecting both the advantages and drawbacks of these financial tools. Positive feedback often highlights the ease of account setup, while negative comments frequently center around limitations in transaction capabilities. Understanding these diverse perspectives provides valuable insights into the overall sentiment surrounding this type of banking.

Positive Customer Experiences

Customers frequently praise the streamlined account opening process, often describing it as fast and straightforward. This ease of access is particularly appealing to individuals who may not have the time or resources to navigate traditional banking procedures. Many find the application process remarkably user-friendly, with minimal paperwork and online forms. The ability to manage finances digitally is also often highlighted as a key benefit, offering convenience and control.

Common Customer Complaints

Common complaints regarding no credit check bank accounts often revolve around limitations in transaction limits. Customers may find the daily, weekly, or monthly transaction allowances insufficient for their needs. Other issues may include restrictions on the types of transactions permitted or a lack of ATM access, creating a barrier for daily banking activities.

Customer Feedback Summary

The following table summarizes customer feedback, categorized for clarity:

| Category | Comment |

|---|---|

| Positive | Fast and easy account opening process, convenient online access, and streamlined application procedures. |

| Negative | Limited transaction limits, restrictions on transaction types, and limited ATM access. |

Overall Sentiment

The overall sentiment towards no credit check bank accounts is mixed. While many appreciate the ease of access and digital convenience, the limitations in functionality, particularly transaction limits, often outweigh the benefits for certain customers. Understanding these differing experiences helps to paint a more comprehensive picture of the practicality and suitability of such accounts for various financial needs.

Alternatives and Comparisons

Beyond no-credit-check bank accounts, a spectrum of financial solutions caters to those seeking alternative avenues for managing their funds. These options vary in their requirements, fees, and functionalities, offering different levels of convenience and security. Understanding these alternatives allows for informed decision-making, ensuring a suitable fit for individual financial needs and circumstances.

Alternative Financial Solutions

A diverse array of financial tools stands as viable alternatives to traditional bank accounts, particularly for those needing immediate access to basic financial services without stringent credit checks. Prepaid debit cards, mobile money platforms, and community-based financial cooperatives represent compelling options.

- Prepaid Debit Cards: These cards offer a straightforward way to manage funds without a traditional bank account. Funds are loaded onto the card, and transactions are processed using the loaded balance. This approach simplifies transactions and can be especially helpful for those with limited or no credit history. However, they typically come with transaction fees and limitations on how much can be loaded or withdrawn at once.

This is a common method to manage funds without a bank account.

- Mobile Money Platforms: Digital platforms allow users to send and receive money, pay bills, and access other financial services via their smartphones. They are particularly popular in regions with limited traditional banking infrastructure. The convenience and accessibility are strong points, but the security and regulatory frameworks can vary considerably. Users should thoroughly research the security protocols of the platform to ensure their funds are protected.

- Community-Based Financial Cooperatives: These organizations often serve marginalized communities, providing access to basic banking services, such as savings accounts and loans, without the stringent requirements of conventional banks. They may have specific eligibility criteria, but they often offer lower fees and potentially more tailored financial support for community members.

Pros and Cons of Each Alternative

Careful evaluation of the advantages and disadvantages of each option is essential before making a decision. Understanding the benefits and drawbacks will allow individuals to choose a solution that best aligns with their needs.

- Prepaid Debit Cards: Pros include ease of use, no credit check requirement, and readily available at most retail locations. Cons include potential high transaction fees, limited functionality compared to traditional accounts, and sometimes restrictions on the amount that can be loaded.

- Mobile Money Platforms: Pros include high accessibility, especially in underserved regions, and ease of use with mobile devices. Cons include potential security concerns, varying levels of regulatory oversight, and limited functionalities depending on the specific platform.

- Community-Based Financial Cooperatives: Pros include often lower fees and tailored financial support. Cons may include limited accessibility and potential restrictions on service areas.

Cost and Accessibility Comparisons

The cost and accessibility of these alternatives differ significantly from no-credit-check bank accounts. Prepaid debit cards often involve transaction fees, while mobile money platforms can have varying transaction charges. Community-based financial cooperatives usually have lower fees, but accessibility may be geographically limited. Assessing these factors is crucial for a realistic comparison.

Feature, Fees, and Risk Comparison Table, No credit check bank account no deposit

This table highlights the key features, associated fees, and potential risks of different financial solutions.

| Financial Solution | Key Features | Typical Fees | Potential Risks |

|---|---|---|---|

| Prepaid Debit Cards | Easy to use, no credit check, widely available | Transaction fees, load limits | Limited functionality, potential security issues if not handled properly |

| Mobile Money Platforms | High accessibility, mobile-based | Transaction fees, varying based on platform | Security concerns, inconsistent regulatory oversight |

| Community-Based Financial Cooperatives | Community-focused, tailored support | Lower fees, potential restrictions | Limited accessibility, specific eligibility criteria |

Regulations and Legal Considerations

Navigating the financial landscape requires a keen understanding of the legal and regulatory frameworks surrounding financial products. No-credit-check, no-deposit bank accounts, while offering accessibility, are subject to specific regulations designed to protect consumers and maintain financial stability. These regulations vary significantly across jurisdictions and are crucial for both consumers and providers to understand.Understanding the legal underpinnings of these accounts allows consumers to make informed decisions and providers to operate within the bounds of the law.

This section explores the crucial legal frameworks and regulatory requirements, highlighting the importance of compliance for both parties involved in these financial transactions.

Legal Frameworks and Regulations

The legal landscape surrounding no-credit-check, no-deposit bank accounts is multifaceted and influenced by various national and regional regulations. These regulations often focus on consumer protection, preventing fraud, and ensuring the stability of the financial system. Countries with robust financial regulatory systems typically have more stringent rules and oversight to mitigate risks.

Unburden yourself from the constraints of traditional banking; embrace the freedom of a no credit check bank account no deposit. Unlocking this gateway to financial liberation allows you to explore your culinary adventures, such as discovering the delectable realm of gluten-free options at Wendy’s. This newfound ease, this unfettered access, is a powerful reminder of the limitless potential within you, a potential waiting to be unlocked, just like your new bank account.

Specific Requirements and Restrictions by Jurisdiction

Regulations vary significantly across jurisdictions. For example, in the United States, the Federal Deposit Insurance Corporation (FDIC) and the Office of the Comptroller of the Currency (OCC) play key roles in overseeing banks and bank-like institutions. These agencies impose strict standards on account opening processes and transaction limits to prevent illicit activities. Similarly, the European Union has a robust regulatory framework that mandates specific requirements for financial institutions operating within its member states.

Regulatory Bodies and Agencies

Several regulatory bodies oversee these types of accounts, ensuring compliance and protecting consumer interests. These include central banks, financial regulatory authorities, and consumer protection agencies. For instance, the Bank of England in the UK, the Bank of Canada in Canada, and the Reserve Bank of India in India all have significant regulatory oversight over financial institutions, including those offering no-credit-check accounts.

Their mandates include ensuring transparency, fair practices, and protection from fraud.

Compliance Standards for Providers

Providers of no-credit-check, no-deposit bank accounts must adhere to strict compliance standards. These standards encompass aspects like KYC (Know Your Customer) procedures, anti-money laundering (AML) regulations, and reporting requirements. Examples include maintaining detailed transaction records, verifying customer identities, and reporting suspicious activities. Failure to comply with these standards can lead to significant penalties and legal ramifications. These regulations are critical for maintaining trust and preventing the use of these accounts for illicit activities.

Future Trends and Predictions

The no-credit-check bank account market is rapidly evolving, driven by technological advancements and changing consumer needs. This dynamic landscape presents both exciting opportunities and potential challenges. This section delves into the predicted developments, emerging trends, and potential limitations shaping the future of this market segment.

Potential Developments in Account Features

No-credit-check accounts are likely to become more sophisticated, mirroring the features of traditional banking accounts. Expect to see increased integration with mobile payment systems, offering seamless transactions and enhanced security. Biometric authentication methods, such as fingerprint or facial recognition, will likely become more commonplace to bolster security and convenience. Additionally, the ability to link to and control other financial services, like investment platforms or budgeting apps, is expected to be a key feature.

These integrated functionalities will create a more comprehensive financial management ecosystem.

Emerging Trends and Innovations

The emergence of open banking and fintech solutions will play a crucial role in shaping the future of no-credit-check accounts. Open banking allows for greater data sharing, potentially leading to more personalized financial products and services tailored to individual needs. Fintech companies are developing innovative tools for budgeting, saving, and investment, which will be integrated into no-credit-check accounts.

The integration of artificial intelligence (AI) will likely enhance the account management experience, offering personalized recommendations, fraud detection, and customer support.

Potential Future Limitations and Challenges

Despite the numerous advancements, the no-credit-check bank account market faces potential challenges. Regulatory scrutiny and compliance with financial regulations will be crucial to maintain the security and stability of these accounts. Maintaining customer trust and mitigating the risk of fraud will be paramount. Furthermore, competition from established banks may pose a challenge. Strategies for differentiation and competitive pricing will be crucial to attract and retain customers.

Long-Term Impact on the Market

The long-term impact of no-credit-check accounts is significant. It has the potential to significantly expand financial inclusion by providing access to basic banking services to individuals previously excluded from traditional banking systems. This inclusion can foster economic empowerment and participation, leading to improved financial literacy and stability for those who may not have access to traditional credit lines.

The increased competition and innovation in the financial services industry, spurred by the growth of this market segment, could lead to a broader range of financial products and services tailored to diverse consumer needs.

Final Summary

In conclusion, no credit check bank accounts offer a viable alternative for those seeking banking solutions without a credit history. However, careful consideration of features, fees, and potential risks is crucial. By understanding the nuances of these accounts and exploring alternative solutions, you can make an informed decision that aligns with your financial needs. We hope this guide has equipped you with the knowledge to navigate this evolving landscape.

General Inquiries

What documents are typically required to open a no credit check bank account?

Requirements vary by provider. Generally, you’ll need proof of identity (like a driver’s license or passport) and proof of address (such as a utility bill or lease agreement).

What are the common transaction limits and fees associated with these accounts?

Transaction limits and fees differ significantly between providers. Some may have daily or monthly transaction caps, while others might charge fees for certain services. Always review the provider’s terms and conditions for detailed information.

Are debit cards and ATM access available with no credit check bank accounts?

Many providers offer debit cards for transactions, but ATM access might be limited or require additional fees. Always confirm the availability of ATM access with the specific provider.

What are some potential risks associated with no credit check bank accounts?

Potential risks include limited transaction limits, specific fees, and security concerns if not chosen carefully. Thoroughly research and compare providers before making a decision.