Agreement to provide insurance form pdf is a crucial document for establishing insurance coverage. This guide provides a comprehensive overview of the form’s purpose, components, structure, legal considerations, common pitfalls, alternative formats, and illustrative examples. Understanding these aspects ensures the proper execution of the agreement, minimizing potential issues and ensuring compliance.

This guide will detail the essential elements of the form, including its purpose, components, structure, and legal implications. It will also explore various scenarios where this form is necessary, the common issues to avoid, and the benefits of different formats, from paper to digital.

Understanding the Form’s Purpose: Agreement To Provide Insurance Form Pdf

An “agreement to provide insurance form” is a crucial legal document outlining the terms and conditions under which an individual or entity agrees to provide insurance coverage to another party. This form legally binds both parties, ensuring the insured party receives the agreed-upon protection and the insurer fulfills its obligations. Understanding its purpose, legal implications, and potential consequences is essential for all involved.This form serves as a contract, specifying the type of insurance, coverage details, and the parties’ responsibilities.

Its careful completion and signing are vital to avoid future disputes and ensure the agreement’s enforceability. The form’s structure often includes clauses defining the scope of coverage, exclusions, premiums, and dispute resolution mechanisms.

Purpose and Function of the Form

The primary function of an agreement to provide insurance is to establish a legally binding contract between the insurer and the insured. This contract details the specific terms and conditions governing the insurance coverage, including the type of risk being insured against, the amount of coverage, and the payment obligations. This formalization ensures clarity and reduces ambiguity in the event of a claim.

Legal Implications and Responsibilities

The form creates legal obligations for both parties. The insurer is legally obligated to provide the agreed-upon insurance coverage, while the insured party is responsible for paying premiums and adhering to the policy’s terms and conditions. Failure to fulfill these obligations can lead to legal repercussions. A thorough understanding of the contract’s stipulations is crucial for both parties to avoid potential conflicts.

Types of Insurance Coverage

Insurance coverage can vary significantly, encompassing numerous aspects of risk management. This includes property insurance, liability insurance, health insurance, and life insurance. Each type of insurance has its own unique set of coverage details, and these will be explicitly Artikeld in the agreement to provide insurance form.

Consequences of Incorrect Completion

Incomplete or incorrectly filled-out forms can lead to significant consequences. Incomplete forms may result in the insurance agreement not being legally enforceable. Errors or omissions in the form can lead to disputes and potentially invalidate the coverage in certain circumstances. Careful review and accuracy are paramount. If a party is unsure about any aspect of the form, seeking professional legal advice is highly recommended.

Scenarios Requiring This Form

This form is crucial in numerous scenarios, including:

- Commercial Insurance Agreements: Businesses often use these forms to Artikel the terms of insurance coverage for their assets and operations. This form clearly delineates the types of liabilities that are covered under the policy, and what is excluded.

- Personal Insurance Agreements: Individuals utilize these agreements to secure insurance coverage for their homes, vehicles, or health. This is essential to understand the limits and exclusions to the insurance coverage being provided, as well as the responsibility of both parties involved.

- Insurance Broker Agreements: A broker may provide insurance services on behalf of the client, and the agreement defines the coverage, responsibilities, and compensation.

Example of Insurance Coverage Details

The following table illustrates a potential structure for an agreement to provide insurance form. It details the type of insurance, coverage details, and the relevant parties involved.

| Type of Insurance | Coverage Details | Relevant Parties |

|---|---|---|

| Property Insurance | Coverage for damage to a building, including fire, vandalism, and storms | Homeowner (insured), Insurance Company (insurer) |

| Liability Insurance | Protection against claims of injury or damage caused by the insured | Business owner (insured), Insurance Company (insurer) |

| Health Insurance | Payment for medical expenses incurred by the insured | Individual (insured), Insurance Company (insurer) |

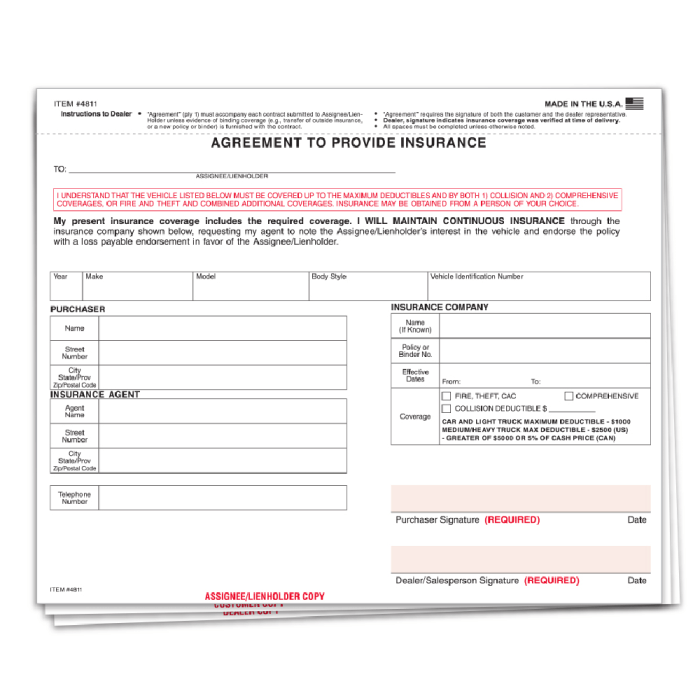

Components of the Form

An agreement to provide insurance, often a crucial document in various financial transactions, Artikels the terms and conditions under which an insurance provider commits to covering specific risks for a policyholder. Understanding the structure and key components of this form is vital for both parties to ensure clarity and prevent future disputes. This section delves into the essential elements of such an agreement, emphasizing their legal significance.

Key Components

The agreement to provide insurance typically comprises several key components, each serving a specific legal function. A well-structured form clarifies the obligations of both the insurer and the insured, minimizing ambiguity and potential conflicts. The following table details the typical sections and their importance:

| Form Section | Description | Legal Significance |

|---|---|---|

| Policy Details | This section identifies the specific type of insurance coverage, policy number, effective dates, and policy limits. It also Artikels the insured peril(s) or event(s) covered. | Clearly defines the scope of coverage and the insured’s rights. Accurate details prevent disputes about what is or is not covered. |

| Insured Party Information | Identifies the individual or entity (the insured) for whom the insurance coverage is intended. Includes their name, address, and other relevant identifying information. | Establishes the identity of the insured and the party entitled to the insurance benefits. Ensures that claims are directed to the correct party. |

| Premium Payment Details | Artikels the payment schedule for premiums, the payment methods accepted, late payment penalties (if applicable), and any other premium-related stipulations. | Defines the financial obligations of the insured and ensures the insurer receives the agreed-upon premiums. Clear clauses prevent disputes over payment. |

| Claims Procedures | Specifies the process for filing a claim, including required documentation, claim forms, and deadlines. It also defines the insurer’s obligation to investigate and process the claim. | Establishes a clear framework for handling claims, minimizing ambiguity in the claim process and preventing unnecessary delays. Sets expectations for both parties in a claim scenario. |

| Exclusions | Identifies specific risks or circumstances not covered under the insurance policy. This section Artikels the limits of the insurer’s liability. | Clearly delineates what is not covered, preventing misunderstandings and disputes when a claim is made. It defines the extent of the insurer’s commitment. |

| Governing Law | Specifies the jurisdiction and laws that govern the agreement in case of a dispute. | Establishes the legal framework for resolving any disputes that may arise from the agreement. This is crucial for determining applicable laws and court systems. |

| Signatures and Dates | Includes spaces for the signatures of both the insured and the insurer, along with the dates of execution. | Validates the agreement and provides evidence of its acceptance by both parties. Dates are crucial for establishing the effective period of the agreement. |

Example Structure

An agreement to provide insurance form typically includes a preamble stating the intent of the agreement, followed by detailed clauses on the specific coverage. Sections outlining premium payment, claims procedure, and exclusions are essential. The final section includes clauses for governing law, signatures, and dates.

This structured approach ensures clarity and accountability for both parties involved in the insurance agreement. Each component is vital in establishing the rights and obligations of the insured and the insurer, providing a strong legal foundation for the insurance policy.

Form Structure and Format

A well-structured insurance agreement form is crucial for clarity, comprehension, and minimizing misunderstandings. Proper formatting significantly impacts the user experience and ensures the form accurately reflects the terms and conditions of the agreement. This section will explore best practices for structuring the form, presenting information effectively, and employing clear language.

Optimizing Form Clarity

Effective form structure is paramount for ease of understanding. A logical flow of information, combined with clear labeling and concise language, significantly reduces the chance of errors or confusion. The form should be organized in a way that guides the user through the necessary steps, from providing basic information to signing the agreement. This structured approach promotes comprehension and minimizes the risk of overlooking important details.

Presenting Information for Understanding

Presenting information in various formats enhances user comprehension. Using a combination of text, tables, and visual aids, such as checkboxes or radio buttons, can improve the overall understanding of the agreement. For instance, complex clauses or conditions can be presented in a clear and concise manner using bullet points. This approach allows users to quickly grasp the key elements and ensures the agreement is easily understood.

Importance of Clear and Concise Language

Clear and concise language is essential for preventing misinterpretations. Jargon or overly complex terminology should be avoided. The language should be straightforward and easy to understand, ensuring that all parties involved comprehend the terms of the agreement. Using plain language is essential for clarity and avoids ambiguity, which can be crucial in legal contexts.

Effective Formatting Techniques for Readability

Effective formatting significantly impacts readability. Employing headings, subheadings, and bullet points can break down complex information into digestible chunks. Using white space effectively enhances the overall appearance and ensures the form is easy to navigate. Consistent formatting throughout the document improves the user experience and contributes to the professional appearance of the agreement. Example: Using different font sizes for headings and subheadings creates visual hierarchy.

Comparison of Form Structures

| Form Structure | Pros | Cons |

|---|---|---|

| Chronological | Easy to follow, step-by-step approach. | May not be suitable for complex agreements. |

| Categorical | Allows for focused sections, making it easier to locate specific information. | Might not be intuitive for users unfamiliar with the categories. |

| Combined | Combines the best of both approaches. | Requires careful planning to maintain clarity. |

Headings, Subheadings, and Bullet Points

Using headings and subheadings establishes a clear hierarchy of information. This structure allows users to quickly scan the form and locate specific sections. Bullet points are particularly useful for highlighting key terms or conditions. For example, a subheading “Policy Exclusions” followed by bullet points outlining the exclusions clarifies the agreement’s terms. This method significantly improves the user experience.

Legal Considerations

Insurance agreements, crucial for risk transfer, must adhere to stringent legal requirements. These regulations ensure fairness, transparency, and protect the interests of all parties involved. Understanding these legal frameworks is paramount for creating valid and enforceable contracts.Applicable laws and regulations play a pivotal role in shaping the structure and content of insurance forms. These forms must not only be legally sound but also effectively communicate the terms and conditions of the agreement.

This meticulous attention to legal detail is essential for minimizing potential disputes and ensuring compliance with industry standards.

Considering the agreement to provide insurance, a crucial step is reviewing the form. Finding suitable housing, like a 1-bedroom apartment under $700 near me, here are some options, can often be a blessing. This form ensures we’re all covered, ensuring a smooth transition and peace of mind. Let’s ensure the agreement to provide insurance form pdf is complete and accurate.

Legal Requirements and Regulations

Insurance contracts are governed by a complex web of state and federal laws. These laws dictate the permissible terms, conditions, and exclusions within the agreement. For example, state laws often dictate the required disclosures, such as policy limitations or exclusions, and the procedure for dispute resolution. Federal laws, like those related to consumer protection, also impose specific requirements on the content and presentation of insurance forms.

Role of Applicable Laws and Regulations

Applicable laws and regulations dictate the structure and language of the insurance agreement. These laws define the permissible scope of coverage, exclusions, and limitations. They also Artikel the rights and responsibilities of both the insurer and the insured. The forms must accurately reflect these requirements. Failure to comply can lead to the contract being deemed invalid or unenforceable.

Examples of Clauses Complying with Regulations

Clear and concise language is essential. A clause specifying the geographical limitations of coverage, for example, must be unambiguous. This clause should clearly define the areas where the policy applies and the specific exceptions. Similarly, clauses relating to premium payments should be detailed and compliant with consumer protection laws, outlining payment methods, deadlines, and late payment penalties.

The form must be easy to understand, avoid ambiguity, and adhere to disclosure requirements.

Importance of Legal Counsel Review

Independent legal counsel is essential for reviewing insurance forms. Legal experts can identify potential ambiguities, ensure compliance with all applicable laws and regulations, and protect the interests of the parties involved. This review process safeguards against unforeseen legal issues and ensures the form effectively reflects the intended terms and conditions. The expertise of legal counsel is invaluable in avoiding costly disputes and potential legal challenges.

Table of Legal Considerations and Implications

| Legal Consideration | Associated Implications |

|---|---|

| Compliance with State Insurance Codes | Ensures contract validity and enforceability; Non-compliance could lead to contract invalidity. |

| Consumer Protection Laws | Protects insured parties from unfair or deceptive practices; Failure to comply could result in legal action. |

| Contract Formation Requirements | Ensures the agreement meets the legal criteria for a binding contract; Non-compliance could render the contract unenforceable. |

| Clear and Concise Language | Promotes mutual understanding and reduces potential disputes; Ambiguity can lead to costly litigation. |

Comparison of Jurisdictions

Different jurisdictions have varying requirements for insurance agreements. For instance, some states may have stricter regulations regarding policy exclusions or coverage limits. Understanding these variations is crucial for ensuring compliance across multiple jurisdictions. The use of model legislation and standardized forms can help mitigate some differences, but legal counsel familiar with each jurisdiction is critical.

Common Issues and Pitfalls

Creating and using insurance agreement forms requires meticulous attention to detail to avoid potential disputes and legal liabilities. Errors, ambiguities, and omissions can lead to costly misunderstandings and protracted legal battles. Thorough review and understanding of the form’s components are crucial to mitigate these risks.Careless drafting or incomplete execution can have serious consequences. Understanding the common pitfalls and potential issues associated with these forms is essential for both the insurer and the insured party.

This section explores these issues, providing practical guidance to avoid common problems.

Potential Errors in Form Creation

Errors in the form’s creation can stem from several factors, including lack of clarity, insufficient detail, and inadequate legal review. Ambiguity in wording can lead to different interpretations by the parties involved, ultimately creating a foundation for disputes. For example, vague definitions of covered events or exclusions could lead to disagreements about coverage when a claim arises. Poorly worded clauses, or clauses that are not tailored to the specific circumstances, can result in unexpected outcomes.

Misinterpretations and Ambiguities

Misinterpretations of the form’s clauses can arise from differing levels of legal expertise among the parties involved. Ambiguous language, especially in complex insurance policies, can create a fertile ground for misinterpretations. This is particularly true in clauses that define coverage, exclusions, and limitations of liability. For example, a clause that describes “sudden and accidental” damage might be interpreted differently by the insured and the insurer, leading to a dispute over coverage.

These ambiguities can be minimized by using precise language, avoiding jargon, and seeking legal counsel when needed.

Considering the agreement to provide insurance form PDF, have you considered the local eateries? Finding a suitable restaurant in the Sutherland Shire can be challenging, but thankfully, a great selection awaits you at restaurants in the Sutherland Shire. Ultimately, ensuring proper insurance coverage remains paramount, and completing the form is essential for your peace of mind.

Completeness and Accuracy Review

A comprehensive review of the form’s completeness and accuracy is vital. Omissions or inaccuracies can severely impact the form’s validity and enforceability. Ensure all relevant details, such as the policyholder’s information, the specific coverage details, and the premium amount, are accurately recorded. Thorough review should include examining the form’s structure, clauses, and associated documents to ensure consistency and accuracy.

A simple typographical error in a critical clause can have significant consequences.

Clauses Prone to Disputes

Certain clauses in insurance agreements are more susceptible to disputes than others. These include clauses that define covered perils, exclusions, limitations of liability, and the procedures for filing claims. For example, a clause that limits coverage for pre-existing conditions could lead to a dispute if the insured suffers an illness or injury related to a pre-existing condition. Likewise, a poorly defined process for filing a claim could result in delays and disputes.

Liability Associated with Errors

Errors in the insurance agreement form can lead to significant liability for the party responsible for the inaccuracies. This liability could range from financial penalties to legal ramifications, depending on the nature and extent of the error. For instance, an insurer might be held liable for misrepresenting the terms of the policy, leading to a claim being denied unfairly.

Similarly, an insured party could face legal action if they knowingly misrepresented information on the form.

Avoiding Common Issues

To avoid common issues in creating and executing the insurance agreement form, several proactive measures can be taken. Employing clear and concise language, avoiding ambiguous terms, and thoroughly reviewing the form with legal counsel are crucial steps. It’s also essential to ensure the form accurately reflects the specific circumstances of the agreement and complies with relevant laws and regulations.

Thorough understanding of the potential implications of each clause is also critical to preventing disputes. A meticulous approach to drafting, reviewing, and executing the form is crucial to mitigating the risk of costly errors.

Alternative Formats and Tools

Streamlining the insurance agreement process can significantly enhance efficiency and user experience. Alternative formats and digital tools offer opportunities to improve accessibility, security, and overall management of the agreement to provide insurance. This section explores various digital formats, their advantages and disadvantages, and critical considerations for implementing them.Moving beyond traditional paper-based forms, adopting digital alternatives can lead to significant improvements in the insurance agreement process.

From streamlined document management to enhanced security features, digital tools can optimize workflow and reduce the risk of errors associated with manual processes.

Electronic Versions

Electronic versions of the agreement to provide insurance offer a convenient alternative to paper forms. They enable faster processing, reduced storage space requirements, and improved accessibility for stakeholders. This format allows for easy modifications and revisions, ensuring the agreement remains current and accurate. Digital signatures can further enhance the security and authenticity of the document.

Online Portals

Online portals provide a centralized platform for managing insurance agreements. This centralized approach streamlines the process, allowing for secure document storage, easy access for authorized users, and streamlined communication. This approach enables faster processing times and greater efficiency. Integrations with other systems can further enhance workflow and reporting capabilities.

User-Friendly Online Forms

Creating a user-friendly online form is crucial for successful adoption. Clear instructions, intuitive navigation, and a simple design contribute to a positive user experience. Employing a visual design that is easy to understand and navigate is paramount. Visual cues, such as progress bars, can guide users through the form, while providing informative tooltips or hints can help address user confusion.

Digital Security and Data Protection

Ensuring digital security and data protection is paramount when handling sensitive information. Implementing robust security measures, such as encryption and access controls, is essential. Regular security audits and vulnerability assessments help maintain the integrity of the system. Compliance with relevant data protection regulations, such as GDPR, is crucial for legal and ethical operation. Employing multi-factor authentication and secure storage solutions are critical components of a robust security strategy.

Comparative Analysis of Online Form Platforms

Different online form platforms offer varying features and functionalities. A comparative analysis is necessary to identify the platform that best aligns with the specific needs and resources of the organization. Factors to consider include pricing models, scalability, security features, integration capabilities, and customer support. Assessing the compatibility of the chosen platform with existing systems and infrastructure is critical.

Creating a Digital Form (Security Focus)

A secure digital form should prioritize data encryption, secure storage, and access controls. Employing secure protocols, such as HTTPS, is crucial. Implementing multi-factor authentication enhances security, and access controls should be strictly defined based on user roles and responsibilities. Regular security audits and penetration testing should be conducted to identify and address potential vulnerabilities. The chosen platform should have established compliance with relevant data protection regulations, such as GDPR or HIPAA.

The form design should prioritize user experience and security considerations to prevent potential vulnerabilities. Comprehensive documentation of security measures should be maintained.

- Security Protocols: Implementing secure protocols such as HTTPS is a critical step in ensuring data integrity and confidentiality.

- Data Encryption: Encrypting sensitive data at rest and in transit is vital for protecting the confidentiality of information.

- Access Controls: Implementing robust access controls based on user roles and responsibilities is crucial for maintaining data security.

Illustrative Examples

Agreement forms for insurance provision are crucial for defining the terms and conditions of the agreement between parties. These forms Artikel the responsibilities, obligations, and coverage details for the insurance. Properly structured forms ensure clarity, avoid ambiguity, and protect the interests of all involved.Illustrative examples demonstrate various scenarios and structures for these forms, allowing users to tailor them to their specific needs.

This section details several examples, outlining their elements, use cases, and involved parties.

Example 1: Standard Property Insurance

This form is a standard agreement for property insurance. It Artikels the property’s details, the insured amount, the coverage period, and the premium amount.

- Property Description: Includes the address, type of property (e.g., residential, commercial), and a brief description.

- Insured Amount: Specifies the total value of the property covered by the insurance policy.

- Coverage Period: Clearly defines the start and end dates of the insurance coverage.

- Premium Amount: Artikels the total cost of the insurance policy for the specified period.

- Insured Party: Identifies the individual or entity owning the property.

- Insurer: Specifies the insurance company providing the coverage.

This example is suitable for individuals or businesses needing standard property insurance coverage. The parties involved are the property owner (insured) and the insurance company.

Example 2: Specialized Flood Insurance

This form is tailored for flood insurance, addressing unique risks and requirements. It emphasizes specific flood zones and potential exclusions.

- Flood Zone Designation: Clearly identifies the flood zone the property is located in.

- Flood Insurance Rate Map (FIRM) Information: Includes references to the specific FIRM, flood elevation data, and associated risks.

- Exclusion Clauses: Specifies any exclusions related to flood damage from certain events or conditions.

- Additional Coverage Requirements: May include requirements for flood mitigation measures or elevation adjustments.

- Insured Party: Identifies the property owner or renter.

- Insurer: Specifies the insurance company specializing in flood insurance.

This example is crucial for properties located in flood-prone areas. The parties involved are the property owner (insured) and the specialized flood insurance provider.

Example 3: Liability Insurance for a Business

This form covers liability risks associated with a business. It Artikels the specific types of coverage and potential claims.

- Type of Business: Clearly defines the nature of the business activity.

- Coverage Limits: Artikels the maximum amount of liability coverage provided.

- Exclusions: Specifies any exclusions related to specific types of liabilities, such as intentional acts.

- Claims Process: Describes the procedures for filing claims and settling disputes.

- Insured Party: Identifies the business entity.

- Insurer: Specifies the insurance company providing commercial liability coverage.

This form is essential for businesses needing protection against potential liabilities arising from their operations. The parties involved are the business (insured) and the commercial liability insurance provider.

Key Differences Between Examples, Agreement to provide insurance form pdf

| Feature | Standard Property | Specialized Flood | Business Liability |

|---|---|---|---|

| Coverage Type | Property damage | Flood damage | Liability claims |

| Specific Clauses | Standard property damage coverage | Flood zone, FIRM info, exclusions | Business type, coverage limits, exclusions |

| Use Cases | Residential/commercial properties | Flood-prone properties | Businesses facing potential liabilities |

Outcome Summary

In conclusion, the agreement to provide insurance form pdf is a vital document for establishing and managing insurance coverage. This guide has Artikeld the key elements, considerations, and best practices for creating, using, and understanding this document. By adhering to these guidelines, individuals and organizations can navigate the process with clarity and confidence, ensuring compliance and minimizing potential risks.

FAQ Insights

What are the common types of insurance coverage included in the agreement?

The types of insurance coverage vary depending on the specific agreement. Examples include property insurance, liability insurance, health insurance, and auto insurance. The form should specify the exact coverage.

What are the consequences of not completing the form correctly?

Incomplete or incorrectly filled forms may lead to delays in coverage activation, disputes, or even denial of claims. It’s critical to complete the form accurately and thoroughly.

How can I ensure the agreement is legally sound?

Review the form thoroughly for accuracy, and if possible, consult with legal counsel to ensure compliance with relevant regulations. Careful attention to detail and legal review are crucial.

What are some common mistakes when using an online form for the agreement?

Common online form mistakes include incorrect data entry, lack of secure connection, and failure to comply with data protection regulations. Secure platforms and careful data management are vital.