What is EOI for life insurance? It’s like a sneak peek at getting a policy, you know? Instead of filling out the whole application right away, you express your interest. Think of it as a preliminary chat with the insurance peeps to see if you’re a good fit for their policies. This whole process helps you and the insurance company figure out if it’s a good deal for both of you before you dive deep into the paperwork.

It’s totally chill and lets you explore options before committing.

Basically, an EOI (Expression of Interest) is a way to show interest in life insurance without being fully committed to a policy. It’s a chance to discuss different options and see if life insurance is the right fit for your needs. It’s a super helpful way to start the process and potentially save time and money in the long run.

Defining EOI for Life Insurance

An Expression of Interest (EOI) in life insurance represents a preliminary step in the insurance application process. It signals a potential client’s intent to explore life insurance options, providing a crucial initial point of contact between the client and the insurer. This stage allows both parties to assess mutual suitability before proceeding with a formal application.EOIs differ significantly from formal applications.

An EOI is non-binding, merely expressing interest, while a formal application commits the applicant to the process and obligates the insurer to perform due diligence. This distinction is crucial in understanding the various stages of the life insurance journey.

Stages of the Life Insurance Process

The life insurance process typically involves several stages. First, a potential client expresses interest. This is often followed by a detailed discussion of needs and goals, leading to a customized proposal. The insurer then conducts underwriting, a thorough evaluation of the applicant’s health and risk profile, before issuing a policy.

Key Differences Between EOI and Formal Application

| Feature | Expression of Interest (EOI) | Formal Application ||—|—|—|| Binding Nature | Non-binding; expresses preliminary interest | Binding; commits the applicant to the process || Financial Obligation | No financial commitment | Potential financial commitment; premium payments || Insurer Action | Initial assessment and suitability analysis | Underwriting and policy issuance || Purpose | Exploring coverage options and eligibility | Securing life insurance coverage || Level of Detail | Basic information on coverage desired | Extensive health and financial details |

Components of an EOI for Life Insurance

An EOI serves as a vital communication tool, outlining the applicant’s requirements. It’s a concise summary of the key elements for both the client and the insurer.

An expression of interest (EOI) in life insurance typically represents a preliminary inquiry about coverage options. This initial step allows potential policyholders to explore various plans, similar to browsing online recipes for a nutritious meal. For instance, exploring different recipes with kale and ground turkey recipes with kale and ground turkey provides a variety of choices.

Ultimately, the EOI serves as a crucial first step in the insurance selection process, laying the groundwork for informed decision-making.

| Component | Description | Example |

|---|---|---|

| Purpose | Clearly states the reason for expressing interest, often specifying the type of coverage sought (e.g., term life, whole life). | “Seeking term life insurance coverage for a 20-year policy.” |

| Applicant Information | Includes basic details about the individual, such as name, date of birth, and contact information. | Name: John Doe, Date of Birth: 1985-05-15, Address: 123 Main Street |

| Policy Details | Artikels the desired coverage amount and policy term. | Coverage Amount: $500,000, Policy Term: 20 years |

| Contact Information | Provides details for the insurer to contact the applicant for further discussion. | Phone: 555-1212, Email: john.doe@example.com |

Common Scenarios for EOI Use

EOIs are frequently employed in various life insurance scenarios. A client might use an EOI to explore different policy options before committing to a specific plan. This allows the client to gather information and compare various offerings without immediate financial obligation. Insurers use EOI to identify potential clients and to pre-qualify applicants.For instance, a young professional starting a family might use an EOI to gauge the affordability of life insurance coverage to protect their loved ones.

Similarly, an entrepreneur seeking business protection might use an EOI to explore options for key person life insurance, ensuring business continuity. These examples demonstrate the versatility of the EOI in the life insurance industry.

EOI Process and Procedures

The Expression of Interest (EOI) process for life insurance is a crucial initial step in the application journey. It allows potential policyholders to explore coverage options and assess their suitability for various life insurance plans. Understanding the EOI process ensures a smooth transition into the formal application phase.Submitting an EOI typically involves a series of steps designed to gather essential information about the applicant.

This information helps insurers evaluate risk and tailor coverage to individual needs.

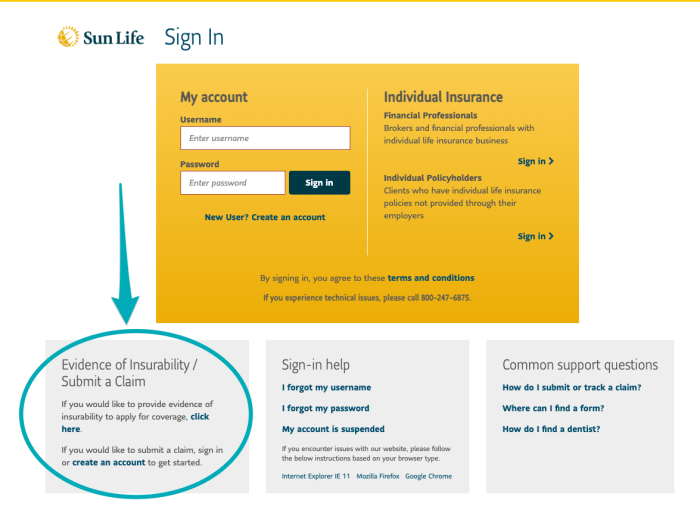

EOI Submission Methods

The submission methods for an EOI are diverse, reflecting the modern, technologically-driven insurance landscape. Applicants can choose from several avenues, each offering convenience and security.

- Online Portals: Many insurers now offer user-friendly online portals. These portals allow applicants to complete the EOI form digitally, providing immediate feedback and the ability to track the status of their submission. This streamlined process often reduces processing time, increasing efficiency for both the applicant and the insurer.

- Physical Forms: While less common, some insurers may still accept physical forms. These forms are typically detailed and comprehensive, requiring careful completion to ensure accuracy. Physical forms often necessitate a more formal process, potentially involving mailing or delivery to the insurer.

Steps in Receiving and Evaluating an EOI

The insurer’s receipt and evaluation of an EOI follows a structured process. This ensures that each submission is thoroughly considered and that all necessary information is obtained.

- Receipt and Preliminary Screening: The insurer receives the EOI submission, whether online or via physical form. A preliminary screening is performed to check for completeness and basic accuracy of the submitted information. This initial review helps quickly identify any obvious issues or missing details.

- Risk Assessment: Once the EOI is deemed complete, the insurer performs a risk assessment. This assessment considers factors like age, health status, lifestyle, and other relevant details provided in the EOI. This assessment helps determine the potential risk associated with insuring the applicant. For example, a younger, healthier individual will likely have a lower risk assessment than an older individual with pre-existing health conditions.

- Suitability Evaluation: Based on the risk assessment, the insurer evaluates the applicant’s suitability for specific life insurance policies. This evaluation determines whether the applicant meets the criteria for the chosen policy type and coverage amount. This stage can identify cases where a different policy or coverage level might be more suitable.

- Policy Recommendation (if applicable): If the applicant meets the criteria, the insurer may offer a policy recommendation. This recommendation will detail the specific policy options and associated premiums based on the assessed risk.

Using EOI for Risk and Suitability Assessment

The EOI plays a crucial role in assessing the applicant’s risk profile and suitability for life insurance. The information provided allows insurers to make informed decisions about potential coverage and pricing.

“A well-completed EOI allows for a more accurate risk assessment, which leads to more suitable and tailored coverage options for the applicant.”

The applicant’s lifestyle and health history, for instance, are considered in determining the level of risk. This allows insurers to provide accurate premiums and appropriate coverage. For example, a person with a history of high-risk activities might be assessed at a higher risk level, leading to a higher premium for the same coverage amount compared to a person with a lower risk profile.

Step-by-Step EOI Completion Guide

A clear understanding of the EOI completion process is essential for a smooth application. This guide provides a step-by-step approach for accurate and efficient completion.

- Gather all necessary documents: This includes personal identification, proof of income, health information, and any other relevant documentation required by the insurer.

- Review the EOI form carefully: Ensure all sections are completed accurately and thoroughly. Double-check the accuracy of all the data to avoid any mistakes that may delay the process.

- Provide complete and truthful information: Honesty and accuracy are paramount. Providing incomplete or inaccurate information could lead to policy denial or rejection.

- Submit the completed EOI: Follow the instructions provided by the insurer regarding submission methods and deadlines.

- Track the status of the EOI: Monitor the progress of the EOI submission to ensure it has been received and processed correctly.

Benefits and Advantages of Using EOI

Early Indication of Interest (EOI) in life insurance presents a streamlined approach to the complex process of securing coverage. This preliminary step offers significant advantages for both prospective policyholders and insurers, fostering a more efficient and informed buying experience. By understanding the EOI process, individuals can make well-informed decisions, while insurers gain valuable insights into market demand and potential policyholders.The EOI process acts as a crucial preliminary step in the life insurance buying journey, enabling both parties to assess suitability and viability before committing to a full policy application.

This proactive approach mitigates potential risks and streamlines the overall process, leading to faster turnaround times.

Advantages for Applicants

The EOI process empowers applicants with valuable insights into their coverage options before committing to a specific policy. This preliminary assessment allows them to compare different insurance providers and policies tailored to their needs. It allows applicants to explore policy features, premium structures, and benefit amounts, giving them a comprehensive understanding of the available options.

Advantages for Insurers

The EOI process provides insurers with an early indication of market demand and potential policyholders. This allows insurers to proactively adjust their product offerings and pricing strategies to meet the evolving needs of the market. By gathering preliminary data through EOIs, insurers can refine their risk assessment procedures and better tailor policies to specific segments of the population.

An expression of interest (EOI) for life insurance signifies a preliminary inquiry, indicating potential interest in purchasing a policy. Understanding the costs associated with pet care, such as dog nail trims, can be a helpful analogy. The price range for dog nail trims varies significantly depending on factors like location and the groomer’s experience, as detailed in this helpful resource: how much does it cost to get dogs nails trimmed.

Similarly, an EOI for life insurance often precedes a more in-depth evaluation of the applicant’s needs and risk profile to determine the appropriate policy and premium.

Comparison with Other Methods

Traditional methods of exploring life insurance options often involve lengthy and complex application procedures. These traditional methods often lack the flexibility and efficiency of the EOI process. The EOI allows for a more streamlined and focused exploration of policy options, enabling a faster decision-making process for both parties. This early indication allows for a more tailored approach to the entire life insurance process.

Time Savings

EOI significantly reduces the time required for securing life insurance coverage. By providing a quick and easy preliminary assessment, the EOI process shortens the overall application time. The ability to assess suitability and policy options upfront prevents unnecessary delays and wasted effort. For instance, if an applicant finds a policy does not meet their needs during the EOI stage, they can avoid the costly and time-consuming process of a full application.

Benefits Summary Table

| Benefit (Applicant) | Benefit (Insurer) |

|---|---|

| Early assessment of coverage options | Early market demand insights |

| Comprehensive policy comparison | Improved risk assessment procedures |

| Reduced application time and cost | Enhanced product tailoring |

| Informed decision-making | Efficient resource allocation |

EOI and Policy Options

Following the Expression of Interest (EOI) submission, the next crucial step in the life insurance journey is understanding the available policy options tailored to individual needs. This process involves exploring different types of life insurance policies, each offering unique features and benefits. A thorough understanding of these policies is essential for selecting a suitable coverage plan that aligns with financial goals and personal circumstances.

Types of Life Insurance Policies

Various life insurance policies cater to diverse needs and risk profiles. Understanding these policy types allows individuals to make informed decisions about the best coverage for their circumstances. The choice depends on factors like desired coverage duration, premium affordability, and future financial objectives.

| Policy Type | Features |

|---|---|

| Term Life | Provides coverage for a specified period (term). Premiums are typically lower than other types, but coverage ends at the term’s expiration. Suitable for individuals seeking temporary protection during critical life stages, such as raising a family. |

| Whole Life | Offers lifelong coverage with a cash value component. Premiums are often higher than term life, but the cash value grows over time, potentially providing a savings component. Suitable for individuals who desire lifelong coverage and a savings vehicle. |

| Universal Life | Provides lifelong coverage with a flexible premium structure and investment options. Premiums and death benefits can be adjusted over time based on market conditions and individual needs. Suitable for those seeking flexibility and potential investment growth. |

| Variable Life | Offers lifelong coverage with investment options that fluctuate based on market performance. Premiums and death benefits are subject to market risk. Suitable for individuals seeking investment growth and willing to accept market-linked risk. |

How EOI Helps Narrow Down Policy Options

An EOI, by providing detailed information about an applicant’s circumstances, assists in refining the selection process. The information gathered helps insurers understand the applicant’s specific financial needs, risk tolerance, and desired coverage amount. This, in turn, enables insurers to recommend policies most aligned with these factors.

Examples of Policy Selection Guidance

Consider a young professional who submits an EOI expressing a need for substantial coverage to protect their family’s future. The EOI may detail their income, debts, and family responsibilities. Based on this information, the insurer can recommend a term life policy with a high death benefit, reflecting the applicant’s need for immediate coverage. Alternatively, an individual approaching retirement and seeking lifelong coverage with a savings component would likely be guided toward a whole life policy, with its cash value accumulation.

Each case requires a personalized approach to finding the most appropriate coverage.

EOI and Risk Assessment

Early expression of interest (EOI) forms a crucial first step in the life insurance process, initiating a risk assessment. Insurers use the EOI to gather preliminary information about the applicant’s health and lifestyle, enabling a rapid evaluation of potential risk. This initial screening helps insurers determine the suitability of the applicant for coverage and the appropriate premium.The EOI serves as a vital tool for insurers to assess the prospective risk associated with insuring a life.

It allows insurers to filter out applicants with significantly higher risk profiles, preventing potentially costly claims. This efficient process saves both time and resources, while ultimately enhancing the overall efficiency and effectiveness of the life insurance market.

Factors Considered During Risk Assessment, What is eoi for life insurance

The risk assessment process, triggered by an EOI, considers a range of factors to evaluate the applicant’s health and lifestyle. These factors are often categorized into health history, lifestyle choices, and financial information. Health history details, for example, include pre-existing conditions, family medical history, and any history of chronic illnesses. Lifestyle choices, such as smoking habits, alcohol consumption, and physical activity levels, are also key elements.

Financial information, including income and expenses, may be considered in some cases to assess the applicant’s financial stability and potential future claims.

Risk Assessment Methods

Insurers employ various methods to assess the risk associated with an EOI. These methods can be broadly categorized as:

- Statistical Modeling: Insurers utilize statistical models based on historical data to predict the likelihood of death or critical illness. These models incorporate factors like age, gender, medical history, and lifestyle choices. For example, a younger, non-smoking male with no known pre-existing conditions would have a lower predicted risk compared to an older, smoking female with a history of cardiovascular disease.

- Expert Judgment: Experienced underwriters use their expertise to interpret the information provided in the EOI. This includes evaluating the applicant’s answers to the questions, assessing any inconsistencies, and drawing on their experience to identify potential risks. This subjective assessment often complements the statistical model, ensuring a comprehensive evaluation.

- Third-Party Verification: Insurers may utilize third-party verification services to validate the information provided in the EOI. This could involve contacting previous employers or healthcare providers to confirm certain details. This approach helps ensure the accuracy and completeness of the data provided by the applicant.

Flowchart of Risk Assessment Process

The following flowchart illustrates the general risk assessment process after an EOI is submitted:

Note: This is a simplified representation. The actual process may vary based on the insurer and the complexity of the application.

Role of Medical Examinations in Life Insurance

Medical examinations play a crucial role in the life insurance process after the EOI. Following the initial risk assessment, a thorough medical examination is conducted to gather more detailed health information about the applicant. This examination often involves a physical check-up, blood tests, and other diagnostic procedures, depending on the insurer’s requirements and the applicant’s situation. The medical examination provides further insights into the applicant’s current health status, potentially identifying factors that were not explicitly stated in the EOI.

Medical examination results are carefully reviewed by qualified medical professionals to assess the applicant’s overall health and potential risks.

EOI and Financial Implications: What Is Eoi For Life Insurance

Submitting an Expression of Interest (EOI) for life insurance initiates a crucial financial evaluation process. Understanding the financial implications of this step is paramount for informed decision-making. This includes scrutinizing the associated costs, comparing different policy options, and recognizing the potential long-term benefits. Ultimately, a thorough grasp of the terms and conditions embedded within any chosen life insurance policy is vital for achieving desired financial security.

Costs Associated with Different Life Insurance Policies

Life insurance policies vary significantly in cost, reflecting the diverse levels of coverage and the specific risks underwritten. Premiums, the periodic payments made to maintain the policy, depend heavily on factors like age, health, and the desired coverage amount. These factors directly influence the overall financial commitment required to secure the chosen insurance.

- Term Life Insurance: Often the most affordable option, term life insurance provides coverage for a specified period. Premiums are typically lower than permanent life insurance, but the coverage expires at the end of the term. A 20-year term policy for a 30-year-old, for example, will likely cost less than a 30-year-old purchasing a whole life policy.

- Permanent Life Insurance (Whole Life, Universal Life): Permanent policies provide lifelong coverage and often include a cash value component that can accumulate over time. However, premiums for these policies tend to be higher than those for term life insurance. For instance, a 30-year-old opting for a whole life policy with a substantial coverage amount will have significantly higher premiums compared to the same individual with a term life insurance policy.

Premium and Coverage Comparison Based on EOI

An EOI allows potential policyholders to compare different life insurance options and their associated costs. This comparison helps individuals tailor their coverage to their specific financial needs and risk tolerance. Premiums and coverage amounts are directly linked. Larger coverage amounts typically result in higher premiums.

| Policy Type | Premium (Example – Annual) | Coverage Amount (Example) |

|---|---|---|

| Term Life (10 years) | $1,500 | $250,000 |

| Whole Life | $3,000 | $250,000 |

| Universal Life | $2,500 | $500,000 |

Note: These are example figures and actual premiums and coverage amounts will vary based on individual circumstances.

Potential Financial Benefits of Obtaining Life Insurance Coverage

Life insurance offers significant financial protection to beneficiaries in the event of the policyholder’s death. The death benefit, the payout to beneficiaries, can serve as a crucial safety net for dependents, covering expenses like mortgages, education funds, or ongoing living costs. A specific example is a family with a primary breadwinner, where the life insurance payout can ensure financial stability for the family in the face of unexpected loss.

“Life insurance provides a crucial financial safeguard, protecting dependents and ensuring financial stability in times of hardship.”

Importance of Understanding Terms and Conditions

Life insurance policies come with a multitude of terms and conditions, including policy exclusions, limitations, and riders. A thorough review of these terms is essential before committing to a policy. Understanding these clauses avoids potential disputes or misunderstandings in the future. Careful scrutiny of the policy document ensures that the policy meets the specific financial needs of the individual or family.

Conclusion

So, what is EOI for life insurance? It’s a totally chill way to start the process, explore options, and get a feel for the whole life insurance scene. It’s like trying on different clothes before buying the perfect one. You’re getting a heads-up on your options, and insurance companies get a chance to assess your needs before diving into the whole application process.

It’s a win-win!

Common Queries

What’s the difference between an EOI and a full life insurance application?

An EOI is a preliminary interest statement, while a full application is the official commitment. Think of an EOI as a quick chat to see if you’re a good fit, and the application as signing the contract.

How long does the EOI process typically take?

It really depends on the insurance company, but it’s usually pretty quick. You can get a response in a few days to a few weeks.

What information do I need to provide for an EOI?

Generally, you’ll need basic personal information, your desired coverage amount, and any health details. The specifics will vary depending on the insurance company.

Can I change my mind after submitting an EOI?

Absolutely! An EOI is totally non-binding, so you can change your mind without any penalties.