NGPF online bank simulation answers are here to help you navigate the world of finance! This comprehensive guide breaks down the simulation’s features, financial concepts, and strategies for success. Learn how to manage accounts, handle transactions, and avoid common pitfalls. Let’s get you on the path to financial mastery!

From understanding different account types and transactions to mastering budgeting and investment strategies, this guide provides clear explanations and actionable insights. We’ll walk you through the simulation, highlighting key features and offering practical advice for tackling various scenarios.

Introduction to NGPF Online Bank Simulation

Yo, future finance gurus! This NGPF Online Bank Simulation is like a real-world bank experience, but way less stressful (and with way fewer angry customers!). It’s designed to give you a taste of what it’s like to manage a bank, make important financial decisions, and learn about the ins and outs of the industry. Basically, it’s a fun and interactive way to get a head start on your financial journey.This simulation isn’t just about having fun; it’s about understanding the complexities of banking and the responsibilities that come with it.

You’ll learn about managing resources, making smart investments, and understanding the factors that influence the success of a bank. It’s all about building your financial knowledge and skills, and making informed choices in a simulated environment.

Simulation Overview

The NGPF Online Bank Simulation is a comprehensive, interactive platform designed to replicate a bank’s operations. It allows participants to experience various aspects of banking, from customer service and account management to loan approvals and financial reporting. The platform aims to enhance understanding of banking principles and decision-making processes.

Key Features and Functionalities

This simulation packs a punch! It’s not just about basic transactions; it delves into the nitty-gritty of banking. Here’s a breakdown of its core features:

| Feature | Description | Example Use Case |

|---|---|---|

| Account Management | Allows users to create and manage various types of accounts (checking, savings, etc.), track transactions, and apply for loans. | A user opens a new checking account, deposits funds, and tracks their account balance. |

| Loan Operations | Facilitates loan applications, approvals, and repayments. Users can learn about different types of loans and their associated risks. | A user applies for a personal loan, and the simulation assesses the creditworthiness and approves or denies the loan based on predefined criteria. |

| Financial Reporting | Provides tools to generate and analyze financial reports, including balance sheets, income statements, and cash flow statements. | A user generates a monthly financial report to track the bank’s performance and identify areas for improvement. |

| Customer Service | Involves handling customer inquiries, resolving disputes, and providing excellent customer service. | A user resolves a customer complaint regarding a transaction or loan. |

| Investment Management | Gives users the opportunity to invest in various financial instruments and manage investment portfolios. | A user invests in stocks, bonds, or other financial assets and monitors their portfolio performance. |

Understanding the Simulation’s Financial Concepts

Yo, future finance gurus! This simulation ain’t just about clicking buttons; it’s about grasping core financial principles. Getting a handle on these concepts is key to nailing the simulation and understanding how real-world banking works. Let’s dive in!This simulation gives you a hands-on experience with managing finances. You’ll be making decisions about accounts, transactions, and budgeting, just like a real-life banker or customer.

Learning these fundamentals will make you a total pro at managing your own cash flow.

Core Financial Concepts in the Simulation

The simulation introduces you to essential financial concepts like budgeting, interest rates, and fees. Understanding these concepts is crucial to success in the simulation and, importantly, in real life. You’ll learn how these factors interact and impact your financial decisions.

Types of Accounts and Transactions

The simulation covers various account types, each with its own set of features and benefits. Different accounts cater to different needs, from everyday spending to long-term savings. Knowing which account is right for a specific transaction is a key skill to master.

- Checking Accounts: These are for everyday transactions like paying bills, making purchases, and receiving deposits. Think of it as your go-to account for quick access to funds. Transactions are usually processed quickly, with low-interest rates.

- Savings Accounts: These are designed for saving money. They usually offer higher interest rates than checking accounts, encouraging you to accumulate funds over time. Savings accounts often have limits on the number of withdrawals per month.

- Credit Cards: These allow you to borrow money for purchases. Understanding credit card interest rates, fees, and payment schedules is important for responsible use. Using a credit card wisely can build your credit history.

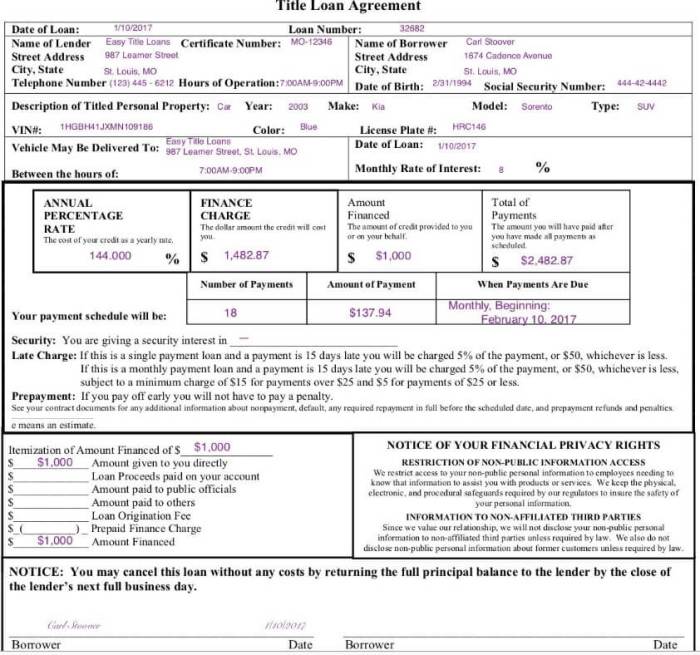

- Loan Accounts: These allow you to borrow money for specific purposes like buying a car or a house. Understanding the terms of a loan, including interest rates and repayment schedules, is crucial for avoiding debt traps.

Interest Rates, Fees, and Budgeting

The simulation will teach you about interest rates, fees, and budgeting, which are crucial aspects of managing finances in the real world. Understanding these factors is vital to making informed decisions and avoiding unnecessary expenses.

- Interest Rates: Interest rates are the percentage charged on borrowed money or earned on deposited money. Different accounts have different interest rates, so choosing the right account for your needs is essential. High interest rates on savings can boost your savings faster. High interest rates on loans can significantly impact the total cost of borrowing.

- Fees: Fees are charges for specific services or transactions. Knowing the fees associated with different accounts and transactions is crucial to avoid unexpected costs. Understanding and managing fees is important to stay within your budget.

- Budgeting: Budgeting is the process of creating a plan for how you will spend and save your money. The simulation encourages you to create a budget and stick to it, which is crucial for financial stability. Tracking your income and expenses will help you manage your money effectively.

Account Comparison

| Account Type | Purpose | Interest Rate | Fees | Accessibility |

|---|---|---|---|---|

| Checking | Everyday transactions | Low | Potentially some transaction fees | High |

| Savings | Saving money | Moderate to High | Limited withdrawals | Moderate |

| Credit Card | Borrowing money | High (Interest) | Annual fees, interest charges | High |

| Loan | Borrowing money for a specific purpose | High (Interest) | Varying fees | Moderate |

Analyzing Transactions and Strategies

Yo, future finance gurus! Navigating the NGPF online bank simulation ain’t just about clicking buttons; it’s about understanding thewhy* behind every transaction and crafting smart strategies to thrive. This section dives deep into common pitfalls and powerful techniques to maximize your virtual bank’s success. Get ready to level up your financial game!Effective financial management in the simulation requires a keen eye for detail and a strategic approach.

Understanding the nuances of different transaction types and their associated fees is key to avoiding costly mistakes and building a sustainable financial portfolio. We’ll explore common pitfalls, discuss winning strategies, and compare various financial management methods to help you make informed decisions.

Common Transaction Errors and Consequences

Knowing the potential landmines in the simulation is crucial to avoid financial setbacks. Poor budgeting, impulsive spending, and overlooking transaction fees can lead to a cascade of negative consequences. Ignoring these factors can result in a depleted account balance and hinder your progress in achieving financial goals.

- Overspending: Ditching the budget and splurging on unnecessary items can quickly drain your virtual funds. Consequences include missing out on potential investments and struggling to cover essential expenses.

- Ignoring Interest Rates: Choosing accounts with lower interest rates can significantly impact your earnings over time. This can be a subtle but significant setback in your long-term financial growth.

- Incorrect Tax Calculations: Inaccurate tax estimations can lead to penalties and financial instability. Understanding tax implications is crucial for sustainable growth.

- Fees Overlooked: Ignoring transaction fees, like ATM withdrawals or insufficient funds, can accumulate quickly and severely impact your account balance.

Effective Strategies for Managing Finances

Developing effective strategies for the simulation is about proactive planning and meticulous execution. Consistency and a disciplined approach are key elements in navigating the virtual banking landscape. Strategies should be tailored to your specific goals within the simulation.

- Creating a Realistic Budget: Develop a comprehensive budget to track income and expenses. This ensures you’re aware of your financial position and can allocate resources effectively.

- Prioritizing Financial Goals: Set clear financial objectives, such as saving for a specific purchase or paying off debt. This helps you stay focused and motivated.

- Utilizing Different Account Types: Understand the nuances of savings, checking, and investment accounts to maximize returns and minimize fees.

- Seeking Financial Advice: Don’t be afraid to seek advice from virtual mentors or advisors in the simulation to gain valuable insights and guidance.

Comparing and Contrasting Financial Management Techniques

Different financial management techniques have unique strengths and weaknesses. Understanding these differences will help you select the most suitable strategy for your financial situation.

- Value Investing vs. Growth Investing: Value investing focuses on undervalued assets, while growth investing targets high-growth potential companies. Understanding these approaches can lead to better investment decisions within the simulation.

- Active vs. Passive Investing: Active investing involves frequent trading decisions, while passive investing emphasizes long-term holdings. Choosing the right strategy aligns with your risk tolerance and investment timeline.

- Debt Management Strategies: Debt management involves strategies to effectively manage and reduce debt. This includes prioritizing debt repayment and using debt consolidation techniques.

Typical Transaction Fees

Understanding the fees associated with different transactions is critical for financial planning. This table Artikels the common fees for various transactions, enabling you to make informed choices.

| Transaction Type | Typical Fee |

|---|---|

| ATM Withdrawal | Rp 5,000 – Rp 10,000 |

| Check Deposit | Free |

| Wire Transfer | Rp 10,000 – Rp 20,000 |

| Insufficient Funds | Rp 2,500 – Rp 5,000 |

| International Money Transfer | Rp 15,000 – Rp 30,000 |

Sample Scenarios and Problem Solving: Ngpf Online Bank Simulation Answers

Yo, future bank moguls! Navigating the NGPF online bank simulation ain’t always smooth sailing. But don’t worry, we’re breaking down some realistic scenarios and showing you how to conquer those financial hurdles. Get ready to level up your bankin’ skills!

Realistic Scenario Example

Imagine you’re managing a small, local bank in the simulation. You’ve got a steady stream of deposits, but a few key customers are requesting larger loans. Simultaneously, you’re facing rising interest rates from your own lending institutions. Managing these competing needs, while trying to maintain a healthy profit margin, is a common challenge. This scenario requires careful analysis of loan risk, customer creditworthiness, and the bank’s overall financial health.

Steps to Solve a Common Problem

To tackle the loan requests while balancing interest rate pressures, a crucial first step is to thoroughly assess the creditworthiness of each applicant. This involves looking at their credit history, income stability, and the overall economic conditions. Next, develop a loan pricing strategy that considers the interest rate hike. This might mean offering slightly higher interest rates on loans or finding ways to diversify your lending portfolio.

Finally, communicate transparently with your customers about the interest rate changes and explore alternative financing options if needed. By following these steps, you can manage loan requests effectively while maintaining profitability.

Resolving a Financial Crisis Table

| Crisis Stage | Immediate Action | Mid-Term Strategy | Long-Term Planning |

|---|---|---|---|

| Sudden Drop in Deposits | Review customer service; identify and address issues immediately. Increase marketing efforts to attract new customers. | Analyze deposit trends; identify reasons for the decline and develop targeted marketing campaigns to retain existing and attract new customers. Explore new deposit products. | Diversify revenue streams; consider other services like wealth management, investment banking or international finance to mitigate reliance on deposits. Implement stronger risk management protocols. |

| Unexpected Loan Defaults | Immediately assess the reason for the defaults. If fraud, contact authorities. Assess the impact on overall capital. | Improve loan underwriting and risk assessment processes. Explore options to restructure or renegotiate loans with troubled borrowers. Strengthen credit risk monitoring systems. | Develop comprehensive risk management strategies and implement rigorous due diligence processes for all future loans. Explore diversification into other financial instruments or sectors. |

| High Operational Costs | Identify areas where costs can be reduced; negotiate better contracts with vendors and suppliers. | Implement cost-saving measures like streamlining operational processes, optimizing technology use, and reducing staff turnover. | Invest in long-term cost-reduction strategies like automation and digitization to improve operational efficiency. |

Practical Business Management Approach

Effective management in the simulation involves a dynamic approach to your bank’s operations. Continuously monitor key performance indicators (KPIs) such as deposit growth, loan portfolio health, and profitability. Regularly analyze market trends and customer behavior to adapt your strategies accordingly. This proactive approach allows you to adjust to changing conditions and maintain a competitive edge.

A strong understanding of financial statements, such as the balance sheet, income statement, and cash flow statement, is essential for informed decision-making.

Don’t just react; anticipate and adapt. This proactive strategy will lead to sustainable success in the simulation.

Illustrative Examples and Case Studies

Yo, future finance gurus! Let’s dive deeper into the NGPF online bank simulation. This section breaks down real-world financial strategies and shows you how to crush it in the game, from savvy savings to smart investments. Get ready to level up your financial IQ!

Successful Financial Management Strategy

A successful strategy in the simulation involves a balanced approach. Prioritizing savings, even small amounts, is key. Simultaneously, exploring low-risk investments, like high-yield savings accounts or certificates of deposit (CDs), can help your virtual cash grow steadily. Don’t forget to track your spending! Regularly reviewing your transactions allows for adjustments to your budget and helps you identify areas where you can save more.

A well-managed budget, combined with consistent savings and careful investments, leads to long-term financial stability. Think of it as building a solid foundation for your future financial success.

Benefits of a Particular Financial Tool

Utilizing online budgeting tools in the simulation can offer several advantages. These tools provide a clear overview of your income and expenses, allowing you to identify spending patterns and areas for potential cuts. Visualizing your financial health in a detailed way helps you understand where your money goes and makes informed decisions. Moreover, the insights gained from tracking spending can motivate you to stick to your financial plan.

Consequences of Poor Financial Decisions

Poor financial decisions in the simulation, like excessive spending or impulsive investments, can quickly lead to a depletion of your virtual funds. This might result in difficulty meeting your financial goals. For example, failing to manage your credit responsibly can lead to high-interest charges and potentially damage your credit score over time, making it harder to borrow money in the future.

Similarly, neglecting emergency funds can leave you vulnerable to unexpected expenses. Understanding the consequences of poor decisions is crucial to developing sound financial habits.

Investment Strategy Comparison

Understanding the nuances of various investment strategies is crucial for optimal financial management. Here’s a comparison of common strategies, considering their pros and cons.

| Investment Strategy | Pros | Cons |

|---|---|---|

| High-Yield Savings Accounts | Low risk, easy access to funds, often FDIC insured | Lower returns compared to other investments |

| Certificates of Deposit (CDs) | Higher returns than savings accounts, fixed interest rate | Limited access to funds for a specific time period |

| Stocks | Potentially higher returns over the long term | Higher risk, significant price fluctuations |

| Bonds | Relatively stable returns, lower risk than stocks | Lower returns compared to stocks |

Understanding the potential upsides and downsides of each strategy helps you choose the best approach for your virtual financial journey. Remember, different strategies suit different financial goals and risk tolerance levels. Each strategy has its own strengths and weaknesses, so choosing the right one for your needs is important.

Simulation Tools and Techniques

Yo, future finance gurus! Navigating the NGPF online bank simulation ain’t rocket science, but it does take some savvy. Understanding the tools and techniques can seriously boost your performance and help you master the virtual world of banking. We’ll break down effective strategies, practical tips, and a structured budgeting approach to help you crush this simulation.This section dives deep into the practical tools and techniques that can help you succeed in the NGPF online bank simulation.

From mastering budgeting to understanding different financial instruments, these tools will equip you with the knowledge to make smart financial decisions. We’ll show you how to leverage these tools to achieve your goals within the simulation.

Effective Tools for Navigation

The simulation platform offers various tools to help you manage your virtual bank effectively. Familiarise yourself with these features; they are your secret weapons. Knowing where to find the right information is key to success.

Sorted out those NGPF online bank sim answers, right? Looking for a chill pad on the Big Island? Check out homes for rent big island hawaii for some top-notch digs. Now, back to nailing those NGPF bank sim questions – gotta get this done before the deadline, you know?

- Transaction History: Reviewing transaction history allows you to track your financial activities. This helps in understanding patterns and identifying areas where you can improve your financial management.

- Account Balance Tracking: Keeping tabs on your account balance is crucial. This lets you monitor your progress and make necessary adjustments to your financial strategy.

- Reporting Features: The simulation likely provides various reports. Analyzing these reports, like profit and loss statements or balance sheets, can give you valuable insights into your performance and identify areas for improvement.

- Customer Relationship Management (CRM) Tools: If the simulation includes CRM, utilize it for managing customer relationships. This helps you stay organized and informed about customer needs and preferences.

Practical Tips for Achieving Goals

Turning your simulation goals into reality is all about strategy. Here are some tips to help you along the way.

- Goal Setting: Define specific, measurable, achievable, relevant, and time-bound (SMART) goals for your virtual bank. This gives you a clear roadmap for your actions.

- Customer Segmentation: If the simulation allows, understanding different customer segments helps tailor your services. This leads to more efficient customer management and can boost profitability.

- Risk Assessment: Evaluate potential risks associated with your financial decisions. This will help you mitigate losses and maintain a stable financial position.

- Experimentation: Don’t be afraid to experiment with different strategies. This can help you discover what works best for you in the simulation.

Structured Approach to Budgeting and Savings

Effective budgeting and savings are crucial for long-term financial success. Follow these steps for a structured approach within the simulation.

- Budgeting: Create a detailed budget outlining your income and expenses. Allocate funds to various categories based on your priorities. This will help you manage your finances efficiently.

- Savings Plan: Establish a savings plan. Set aside a portion of your income for savings. Consider different savings goals, like emergencies, investments, or future purchases. This will ensure you have funds available when needed.

- Investment Strategies: If the simulation allows investment, consider various strategies. Explore different investment options and their potential returns. Be aware of the risks involved with each option.

- Regular Review: Periodically review your budget and savings plan. Adjust as needed based on your progress and changing circumstances. This is vital to staying on track.

Financial Tools and Their Functionalities, Ngpf online bank simulation answers

This table provides an overview of various financial tools and their functionalities in the simulation.

| Financial Tool | Functionality |

|---|---|

| Checking Account | Primary account for holding and managing funds |

| Savings Account | Dedicated account for accumulating savings and earning interest |

| Loans | Borrowing funds for various purposes |

| Investment Accounts | Investing funds to generate returns |

| Credit Cards | Extending credit to customers |

Potential Challenges and Solutions

Navigating the NGPF online bank simulation can be tricky, especially when dealing with fluctuating market conditions and managing multiple accounts. This section breaks down common pitfalls and provides strategies to succeed, so you can ace this simulation like a pro! Understanding these challenges is key to optimizing your performance and building a strong financial foundation.This section details the common challenges faced by users in the NGPF online bank simulation and proposes effective solutions.

It also highlights the importance of strategic planning and adaptation in the dynamic environment of the simulation.

Common User Challenges

Effective simulation performance hinges on understanding the potential hurdles. These include managing multiple accounts with varying needs, comprehending complex financial concepts, and adapting to dynamic market conditions. The simulation’s diverse range of transactions and strategies demands a comprehensive approach. Ignoring these aspects can lead to unexpected losses or missed opportunities.

Strategies for Overcoming Challenges

Addressing the challenges head-on is crucial. Developing a structured approach to account management is key. Understanding financial concepts and practicing effective transaction analysis can significantly improve outcomes. Adaptability is paramount. Learning to adjust strategies based on changing market conditions is a crucial skill for success.

Importance of Planning and Adaptation

Planning is essential for success in the simulation. A well-defined strategy, adaptable to shifting market conditions, is crucial. Anticipating market fluctuations and adjusting your approach accordingly will significantly enhance your performance. Think of it like playing a dynamic game, where your moves must respond to changing circumstances.

Pitfalls and Prevention Strategies

A structured approach to avoiding pitfalls is crucial. The following table Artikels common mistakes and effective solutions to mitigate their impact.

| Common Pitfalls | How to Avoid Them |

|---|---|

| Ignoring Market Fluctuations | Constantly monitor market trends. Analyze news and adjust investment strategies accordingly. The simulation mirrors real-world markets, so adaptability is crucial. |

| Poor Account Management | Develop a clear system for managing different accounts. Track transactions and balances diligently. Using spreadsheets or financial software can help. |

| Lack of Financial Knowledge | Thoroughly research and understand financial concepts. The simulation tests your understanding of various financial instruments. Resources like online tutorials or study guides can help. |

| Failure to Adapt to Changing Conditions | Develop strategies that allow flexibility and adaptation. The simulation environment is not static; your actions must be agile. Learn to analyze data to adjust your approach as needed. |

| Overlooking Transaction Details | Carefully review each transaction for accuracy and potential implications. The simulation rewards attention to detail. Double-checking figures and terms of agreement is crucial. |

Comprehensive Overview and Summary

Yo, future finance gurus! This NGPF online bank simulation ain’t just a game; it’s a crash course in real-world banking. Get ready to dive deep into the world of transactions, strategies, and financial principles. This overview breaks down the whole simulation, from its structure to the vital financial concepts you need to nail it.This section provides a complete picture of the simulation, highlighting its key elements and how understanding these aspects can lead to success.

We’ll dissect the simulation’s design, showcase its features, and emphasize the critical role of financial literacy in achieving positive results.

Simulation Structure and Design

The simulation is meticulously crafted to mirror a real-world banking environment. It presents a series of scenarios and challenges that require strategic decision-making, emphasizing the importance of balancing risk and reward in financial management. The simulation’s design fosters a hands-on learning experience, allowing you to practice various banking functions and experience the consequences of different choices. It’s designed to challenge you and show you how the real world works.

Key Features and Functionalities

The simulation offers a diverse range of features and functionalities to provide a comprehensive learning experience. From opening accounts to managing loans and investments, you’ll engage with a wide spectrum of banking operations. Each action has real-world implications, making the experience engaging and educational.

- Account Management: Setting up various account types (checking, savings, etc.), managing deposits, withdrawals, and transfers is a core aspect. Understanding the nuances of different account types is crucial for effective financial management.

- Loan Operations: Simulating loan applications, approvals, and repayments allows you to experience the intricacies of lending. This helps you grasp the risk assessment process and the importance of creditworthiness.

- Investment Opportunities: The simulation offers opportunities to invest in different instruments. Understanding market fluctuations and potential returns is vital for maximizing investment strategies.

- Transaction Processing: You’ll process various transactions, gaining hands-on experience in handling customer requests, ensuring accuracy, and managing financial records.

Key Financial Concepts

Mastering financial concepts is crucial for successful navigation of the simulation. These principles form the foundation of sound financial decision-making, applicable beyond the simulation itself.

- Risk Management: Recognizing and mitigating risks associated with different financial decisions is paramount. The simulation highlights the importance of evaluating risks and implementing appropriate strategies to minimize potential losses.

- Interest Rates: Understanding how interest rates impact borrowing and lending decisions is vital. The simulation will present situations where you’ll need to consider interest rates when making investment or loan decisions.

- Customer Relationship Management: Managing customer relationships effectively is crucial for success in the simulation. This section stresses the importance of building strong customer relationships and providing excellent service.

- Financial Statements: Understanding financial statements, such as balance sheets and income statements, is critical for evaluating financial health and making informed decisions. You’ll learn how to interpret these statements to gauge the financial position of the bank and your clients.

Summary Table

This table summarizes the key features, functionalities, and concepts of the simulation, making it easier to grasp the overall picture.

| Feature | Functionality | Key Concepts |

|---|---|---|

| Account Management | Opening, managing, and interacting with various accounts | Account types, deposits, withdrawals, transfers |

| Loan Operations | Simulating loan applications, approvals, and repayments | Risk assessment, creditworthiness, interest rates |

| Investment Opportunities | Investing in different instruments | Market fluctuations, potential returns, portfolio management |

| Transaction Processing | Handling customer requests and managing financial records | Accuracy, efficiency, customer service |

Importance of Financial Principles

Understanding fundamental financial principles is paramount to achieving success in the simulation. It’s not just about completing tasks; it’s about applying practical knowledge to achieve optimal results. Successful completion relies heavily on the ability to apply these principles. The simulation is designed to reinforce these principles and allow you to build a strong foundation in financial management.

Sorted out those NGPF online bank sim answers, right? Thinkin’ about opening a new account? Cadence Bank in Amory MS might be worth a look , but the sim answers still need to be cracked first. Gotta get that virtual cash flow sorted before anything else, ya know?

Final Summary

So, you’ve conquered the NGPF online bank simulation! This guide has equipped you with the knowledge and tools to succeed. Remember, financial literacy is key to achieving your goals. Whether you’re a student, a professional, or just someone looking to sharpen their financial skills, this simulation and our guide can be your helpful partner. Semoga bermanfaat!

Question Bank

What are the common transaction errors in the simulation?

Common errors include forgetting to pay bills on time, exceeding credit limits, and not properly tracking expenses. These mistakes can lead to penalties and account issues.

How can I manage a simulated business within the simulation?

Managing a simulated business involves understanding cash flow, tracking expenses, and ensuring revenue meets costs. Effective budgeting and strategic decision-making are crucial.

What are some potential challenges users face in the simulation?

Common challenges include managing multiple accounts, understanding interest rates and fees, and making informed investment decisions. Adapting to market fluctuations is also a key skill.

What are the pros and cons of different investment strategies in the simulation?

Different investment strategies have varying risk levels and potential returns. This simulation helps you explore the trade-offs associated with different approaches, enabling informed decisions.