Bank of Hawaii cashier’s checks: a secure and trusted payment method in today’s fast-paced world. Understanding how they work, from obtaining them to verifying their authenticity, is key for smooth transactions and avoiding potential pitfalls. This guide offers a comprehensive overview, covering everything from security features to legal implications.

Navigating the world of financial instruments can feel overwhelming. This resource provides a clear, concise explanation of Bank of Hawaii cashier’s checks, empowering you to confidently use them in your financial dealings. We break down the intricacies of these checks, helping you understand their advantages, risks, and the essential steps for secure transactions.

Overview of Bank of Hawaii Cashier’s Checks

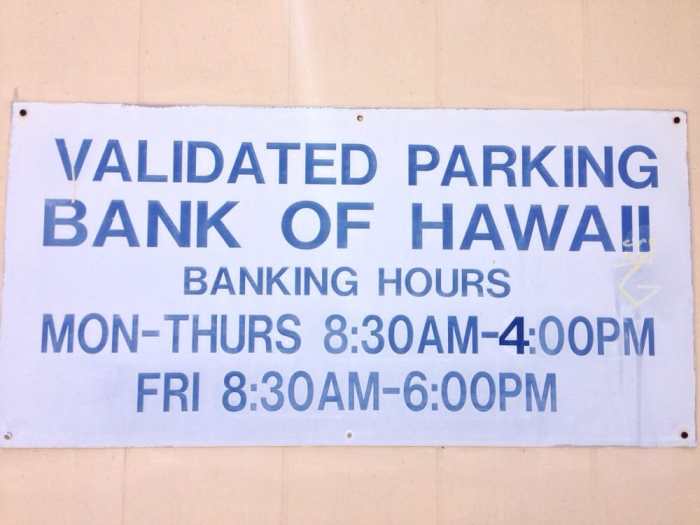

A Bank of Hawaii cashier’s check is a financial instrument that guarantees payment. Issued by the bank itself, it represents a promise to pay a specific amount to a designated recipient. This ensures the recipient receives the funds without the risk of non-payment associated with personal checks. It’s a reliable and secure way to transfer funds, especially in transactions requiring a high level of trust.Obtaining a Bank of Hawaii cashier’s check typically involves visiting a branch and providing necessary information, such as the payee’s name and address and the amount.

The process is straightforward and usually takes only a few minutes to complete. Customers may need to present valid identification. The specific requirements may vary slightly, and it is advisable to consult with a Bank of Hawaii representative for clarification on the latest procedures.

Process of Obtaining a Bank of Hawaii Cashier’s Check

The process for obtaining a cashier’s check is generally straightforward. Customers must typically present a valid form of identification, such as a driver’s license or passport. They then provide the necessary details, including the recipient’s name and address, the amount of the check, and the desired memo or description. The bank verifies the information and issues the cashier’s check.

Security Features of a Bank of Hawaii Cashier’s Check

Bank of Hawaii cashier’s checks are designed with several security features to prevent counterfeiting. These features often include unique serial numbers, watermarks, and microprinting, which are difficult to replicate. The paper itself might have special textures or inks that are hard to forge. The bank’s logo and security features are meticulously crafted to ensure the check’s authenticity. These security measures provide a high level of protection against fraudulent activities.

Typical Uses of a Bank of Hawaii Cashier’s Check

Cashier’s checks are frequently used in situations where a high degree of security and certainty is required. These checks are ideal for large transactions, such as real estate purchases, business payments, and government-related transactions. They also are often used when making payments to individuals or organizations where the sender wants to ensure the payment is honored without question.

Comparison of Bank of Hawaii Cashier’s Checks and Personal Checks

| Feature | Bank of Hawaii Cashier’s Check | Personal Check |

|---|---|---|

| Issuer | Bank of Hawaii | Individual |

| Payment Guarantee | Guaranteed by the bank | Dependent on the account holder’s funds |

| Security | Enhanced security features (e.g., watermarks, microprinting) | No inherent security features |

| Transaction Reliability | Highly reliable | Reliance on the account holder’s creditworthiness |

| Use Cases | Large transactions, transactions requiring certainty | Everyday transactions, payments to individuals |

Features and Benefits

A Bank of Hawaii cashier’s check offers a unique blend of security and convenience, making it a valuable tool for both personal and business transactions. Its guaranteed payment status and readily verifiable authenticity set it apart from other payment methods. This robust feature makes it an ideal choice when dealing with significant sums of money or when absolute certainty of payment is crucial.Beyond personal transactions, the cashier’s check plays a critical role in the financial landscape of businesses.

Its reputation for reliability and security fosters trust and facilitates smooth operations. Its use in business transactions ensures transparency and accuracy, minimizing potential financial disputes.

Advantages Over Other Payment Methods

Bank of Hawaii cashier’s checks stand out due to their guaranteed payment status. Unlike personal checks, which are subject to insufficient funds or stop payment issues, a cashier’s check represents a direct obligation of the issuing bank. This assurance of payment offers a higher level of security and reliability for the recipient. Further, the cashier’s check’s unique design and security features deter forgery, adding another layer of protection against fraud.

The inherent trust associated with the bank’s backing further enhances its standing as a secure payment method.

Role in Business Transactions

In the realm of business, a cashier’s check acts as a cornerstone of secure transactions. Its use facilitates the smooth transfer of funds, minimizing the risk of bounced checks and related complications. Businesses often use cashier’s checks for large purchases, significant payments, or transactions requiring an undeniable commitment to payment. This reliability translates to a streamlined workflow and reduced administrative overhead, enabling businesses to focus on their core operations.

For example, a company purchasing a piece of equipment or making a substantial down payment on a building may use a cashier’s check for the transaction.

Handling and Storage

Proper handling and storage of a Bank of Hawaii cashier’s check are essential to maintain its integrity and prevent potential damage or fraud. Always handle the check with care, avoiding wrinkles or tears. Store the check in a secure location, away from direct sunlight or extreme temperatures. The check should be stored in a manner that protects its unique serial number and other identifying features.

Storing the check in a secure folder or envelope is recommended. Never leave a cashier’s check unattended in a public area or in a place where it can be easily accessed by unauthorized individuals.

Potential Risks

While generally secure, Bank of Hawaii cashier’s checks are not entirely without risk. The potential for fraud, though rare, exists. Always meticulously examine the check for any signs of alteration or tampering before accepting it. If any discrepancies are observed, the check should be promptly rejected. Another risk is the possibility of loss or theft.

Storing the check in a secure location is paramount to minimize this risk. Thorough verification of the check’s authenticity before accepting it is crucial to mitigating potential risks.

Denominations Available

| Denomination | Amount |

|---|---|

| $100 | One Hundred Dollars |

| $250 | Two Hundred Fifty Dollars |

| $500 | Five Hundred Dollars |

| $1,000 | One Thousand Dollars |

| $2,500 | Two Thousand Five Hundred Dollars |

| $5,000 | Five Thousand Dollars |

| $10,000 | Ten Thousand Dollars |

This table Artikels the common denominations offered by Bank of Hawaii for cashier’s checks. The availability of specific denominations might vary depending on the branch or transaction specifics. It is advisable to confirm with the bank regarding specific denomination availability.

Verification and Validation

Protecting your financial transactions is paramount, especially when dealing with cashier’s checks. Proper verification and validation procedures are crucial to ensure the authenticity and legitimacy of a Bank of Hawaii cashier’s check. This section details the steps to verify the authenticity of a Bank of Hawaii cashier’s check and helps you identify potential fraudulent instruments.The integrity of a cashier’s check relies heavily on its accurate validation.

A meticulous examination of key features and components is essential to prevent financial loss. A flawed or fraudulent check can result in significant financial repercussions.

Authenticating a Bank of Hawaii Cashier’s Check

Validating a Bank of Hawaii cashier’s check involves a multi-faceted approach. First, focus on the visible features, then delve into the details to confirm authenticity.

Step-by-Step Validation Procedure

This detailed procedure Artikels the steps to follow when validating a Bank of Hawaii cashier’s check:

1. Visual Inspection

Carefully examine the check for any irregularities or inconsistencies in printing, font, or paper quality. Look for any signs of alterations, tampering, or unusual markings. Discrepancies can be a red flag.

2. Signature Verification

The signature on the check should precisely match the signature on the bank’s records. Discrepancies in the signature’s form or style could indicate forgery. A thorough comparison is critical.

3. Account Number Verification

The account number printed on the check must precisely correspond to the account number maintained by Bank of Hawaii. Any deviation raises a red flag. The accuracy of this number is crucial.

4. Bank of Hawaii Watermark/Security Features

Examine the check for any unique Bank of Hawaii security features like watermarks, embedded fibers, or microprinting. These features, when present, add another layer of authentication.

5. Check Date and Amount

Ensure that the check date and amount are legible and without any alterations. The numerical and written amounts must precisely match.

Identifying Potential Fraud

Fraudulent cashier’s checks often share similar characteristics. Pay close attention to these red flags:* Poor Print Quality: Checks with blurry or uneven printing may be a sign of forgery. Look for sharp, distinct printing.

Suspicious Alterations

Any alterations or changes to the check’s details (amount, date, or payee) raise immediate suspicion. Verify the check’s original form.

Inconsistent Information

Mismatches between the check’s information and other supporting documents or records should be investigated.

Unknown or Unfamiliar Payee

Checks made out to unfamiliar or untraceable payees should be handled with extreme caution. Verify the payee’s identity.

Thinking about a Bank of Hawaii cashier’s check? While the exact pay for a Bank of Hawaii cashier isn’t readily available, it’s worth considering that a job like that likely pays more than a pizza delivery driver, whose salary, according to salary for pizza hut delivery driver , varies significantly based on experience and location. So, a Bank of Hawaii cashier’s check probably offers a more substantial return on investment, all things considered.

Generic or Suspicious Language

So, I was recently researching Bank of Hawaii cashier’s checks, and it got me thinking about comfort food. Specifically, the Cheesecake Factory’s famous white chicken chili recipe, which I’ve always wanted to recreate. I’ve found a great recipe for that cheesecake factory white chicken chili recipe , and now I’m back on track to figuring out how to manage the Bank of Hawaii cashier’s check process efficiently.

It’s all about balance, really.

Look for unusual phrasing or language that deviates from standard bank communication. Genuine checks typically adhere to standard formats.

Essential Components for Validation

The following table Artikels the key elements to verify when validating a Bank of Hawaii cashier’s check:

| Component | Verification Step |

|---|---|

| Check Number | Verify the check number’s consistency with bank records. |

| Signature | Compare the signature with the bank’s records for accuracy. |

| Account Number | Confirm the account number’s accuracy against the bank’s records. |

| Amount | Ensure the numerical and written amounts precisely match. |

| Date | Examine the date for accuracy and absence of alterations. |

| Payee | Verify the payee’s identity and legitimacy. |

Payment and Acceptance

A Bank of Hawaii cashier’s check represents a significant form of payment, often preferred for its guaranteed funds and security. Understanding the acceptance process, requirements, and deposit procedures ensures smooth transactions and avoids potential issues. Proper validation and verification steps are crucial for both the payer and recipient.

Accepting a Cashier’s Check

Accepting a Bank of Hawaii cashier’s check involves a multi-step process to verify legitimacy and ensure sufficient funds. This process safeguards both the payer and the recipient, preventing fraud and ensuring smooth transactions.

Requirements for Acceptance

To ensure a valid and secure transaction, certain requirements must be met when accepting a Bank of Hawaii cashier’s check. These requirements protect both parties involved, ensuring a reliable and trustworthy payment method. These include:

- Verification of the check’s authenticity: Thorough examination of the check’s details, including the check number, date, and the Bank of Hawaii’s logo, is vital. This prevents fraudulent attempts and ensures the check’s legitimacy. The presence of any inconsistencies should be immediately addressed and the check should not be accepted.

- Matching the signature on the check with the payee’s signature: A crucial step to prevent fraudulent transactions, this verification confirms the check’s authenticity. Comparing the signatures safeguards both parties involved, ensuring that the check is being presented by the rightful recipient. Discrepancies should be investigated further and the check should not be accepted.

- Reviewing the amount and other details on the check: Accurate review of the amount, payee details, and any endorsements is essential. Any discrepancies should raise suspicion and warrant further investigation. The check should not be accepted if these details are unclear or incorrect.

Depositing a Cashier’s Check

Depositing a Bank of Hawaii cashier’s check into a bank account is a straightforward process. It involves presenting the check to your bank teller, who will record the deposit and credit the funds to your account.

Ensuring Funds Availability

Ensuring funds are available when accepting a Bank of Hawaii cashier’s check is paramount. This is accomplished by checking the bank’s available balance on the check.

Methods for Accepting and Processing Bank of Hawaii Cashier’s Checks

The table below Artikels various methods for accepting and processing Bank of Hawaii cashier’s checks. These methods help streamline the process, ensuring smooth transactions and minimizing potential risks.

| Method | Description | Pros | Cons |

|---|---|---|---|

| Direct Deposit | Depositing the check directly into your bank account. | Fast, convenient, reduces risk of loss or theft. | Requires a bank account and online banking access. |

| Cashing the check at a bank | Exchanging the check for cash. | Instant access to funds. | Potentially longer processing time than direct deposit. |

| Using the check as a payment | Using the check to settle a payment obligation. | Convenient for transactions. | The recipient may need to deposit it first. |

Legal Considerations

Bank of Hawaii cashier’s checks, while generally considered secure payment instruments, carry specific legal implications. Understanding these implications is crucial for both the issuing bank and the parties who receive and use these checks. Navigating the legal landscape surrounding cashier’s checks can prevent costly mistakes and ensure smooth transactions.The legal framework governing cashier’s checks is designed to balance the interests of all parties involved.

This framework protects the integrity of the financial system and upholds the trust placed in these instruments as reliable forms of payment. Understanding the nuances of these legal considerations is essential for both the issuing bank and the recipients of cashier’s checks.

Liability of the Issuing Bank

The Bank of Hawaii, as the issuer of a cashier’s check, carries a significant degree of liability. This liability arises primarily from the check’s representation as a guaranteed payment. If a cashier’s check proves fraudulent, the bank is typically held liable for the amount of the check. However, there are specific situations that may limit or eliminate the bank’s liability, such as cases where the bank can demonstrate it acted in good faith and exercised reasonable care in issuing the check.

Legal Recourse for the Recipient of a Fraudulent Check

A recipient of a fraudulent Bank of Hawaii cashier’s check has legal recourse. This recourse may involve filing a civil lawsuit against the forger or the party who presented the fraudulent check, and in some instances, against the issuing bank. The legal avenues available to the recipient will depend on the specific circumstances of the fraud, including evidence of negligence or wrongdoing on the part of the issuing bank.

Legal Implications of Accepting a Counterfeit Check

Accepting a counterfeit Bank of Hawaii cashier’s check can have serious legal repercussions. The recipient might be held liable for the fraudulent check, especially if there’s a lack of reasonable verification or if the recipient’s actions contributed to the fraud. The recipient’s due diligence in verifying the authenticity of the check is crucial.

Legal Responsibilities of Issuer and Recipient

| Party | Responsibilities |

|---|---|

| Issuer (Bank of Hawaii) |

|

| Recipient |

|

The legal responsibilities of both the issuer and the recipient are critical in upholding the integrity and security of cashier’s checks.

Related Documents and Information

Navigating the world of financial instruments can sometimes feel like deciphering a complex code. Fortunately, Bank of Hawaii provides ample resources to demystify cashier’s checks, ensuring a smooth and secure transaction process for everyone. Understanding the supporting documentation, policies, and contact procedures empowers you to make informed decisions and confidently utilize this valuable financial tool.

Resources for Additional Information

A wealth of information awaits those seeking a deeper understanding of Bank of Hawaii cashier’s checks. These resources offer detailed insights, clarifying the nuances of this financial instrument. Bank of Hawaii’s website serves as a comprehensive hub, providing FAQs, downloadable documents, and up-to-date policy statements.

- Bank of Hawaii website: A dedicated section on cashier’s checks offers in-depth explanations, examples, and potential scenarios. This platform is a reliable source for the most current information and frequently asked questions.

- Bank of Hawaii’s Customer Service Portal: This portal often provides quick access to FAQs, policies, and procedures. It’s a convenient way to get answers to your questions without needing to call in.

- Bank of Hawaii’s Brochures and Publications: These materials offer concise overviews of cashier’s checks and their usage, along with important disclaimers and guidelines.

Relevant Bank of Hawaii Policies and Procedures

Bank of Hawaii maintains a comprehensive set of policies and procedures that govern cashier’s checks. These documents Artikel the terms and conditions, safeguarding both the issuer and the recipient. Reviewing these documents is crucial for understanding the bank’s expectations and procedures.

- Bank of Hawaii’s Cashier’s Check Policies: These policies detail the specific guidelines and limitations surrounding cashier’s checks. These documents are essential for compliance and understanding the bank’s position on various aspects of cashier’s check usage.

- Bank of Hawaii’s Terms and Conditions: These comprehensive terms and conditions offer a comprehensive overview of the bank’s policies and procedures, including specific provisions concerning cashier’s checks.

Contacting Bank of Hawaii Customer Service

Navigating the complexities of financial transactions can be simplified by having the right contact information. Knowing how to reach Bank of Hawaii customer service for cashier’s check inquiries ensures prompt resolution and a seamless experience.

- Customer service phone numbers: A dedicated phone line is available for inquiries about cashier’s checks. Having access to this direct line facilitates quick resolutions to issues.

- Online chat support: This feature offers real-time interaction with customer service representatives, enabling swift answers to your queries.

- Email addresses for specific inquiries: Direct email channels are available for queries concerning cashier’s checks. This allows for efficient communication with specialized departments.

Locating the Nearest Bank of Hawaii Branch

Knowing the location of the nearest Bank of Hawaii branch is vital for in-person transactions or inquiries. This ensures convenient access to the bank’s services.

- Online Branch Locator: Bank of Hawaii’s website features a robust online branch locator. This tool helps you find the nearest branch to your location in a matter of seconds.

Bank of Hawaii Contact Information

The following table provides a summary of Bank of Hawaii’s contact information.

| Contact Method | Details |

|---|---|

| Phone Number | (Provide Bank of Hawaii’s customer service phone number here) |

| Email Address | (Provide Bank of Hawaii’s customer service email address here) |

| Website | (Provide Bank of Hawaii’s website address here) |

| Branch Locator | (Provide Bank of Hawaii’s branch locator website address here) |

Security and Fraud Prevention: Bank Of Hawaii Cashier’s Check

Bank of Hawaii cashier’s checks, a cornerstone of secure financial transactions, are unfortunately susceptible to fraudulent activity. Understanding the robust security measures in place and how to spot potential scams is crucial for safeguarding your financial well-being. This section delves into the importance of these measures and provides practical advice to protect against fraud.Protecting against fraud is paramount when dealing with cashier’s checks.

The security features built into these checks, coupled with awareness of common scams, can significantly reduce the risk of financial loss. This section Artikels the critical security measures and provides real-world examples to illustrate how to recognize and avoid fraudulent activities.

Importance of Security Measures

Bank of Hawaii’s cashier’s checks are designed with multiple layers of security to deter fraudulent activity. These measures ensure the authenticity and validity of the checks, protecting both the issuing bank and the recipient. The inherent security is crucial in maintaining trust and confidence in the financial system.

Measures to Prevent Fraudulent Activities

Several measures are implemented to prevent fraudulent activities related to Bank of Hawaii cashier’s checks. These include meticulous record-keeping by the issuing bank, rigorous internal controls, and the use of advanced security printing technologies. These measures aim to prevent unauthorized alterations or forgeries. The bank employs advanced technologies, such as embedded microprinting and watermarks, to enhance the security of the checks.

This proactive approach safeguards against fraudulent activities and maintains the integrity of the financial transaction.

Recognizing and Avoiding Counterfeit Checks, Bank of hawaii cashier’s check

Counterfeit cashier’s checks pose a significant threat. To avoid falling victim to a counterfeit, scrutinize the check thoroughly. Look for inconsistencies in the check’s printing quality, the signature’s appearance, and the overall design. Seek assistance from Bank of Hawaii representatives if any discrepancies are noted. A keen eye and a healthy dose of skepticism can help prevent falling victim to fraudulent schemes.

Common Scams Involving Cashier’s Checks

Several scams utilize cashier’s checks as a tool. One common scam involves requesting a cashier’s check in exchange for a non-existent product or service. Another common scam involves using a counterfeit cashier’s check as payment for goods or services. These schemes exploit the legitimacy of cashier’s checks, making them appealing targets for fraudsters. Be vigilant and verify the legitimacy of any request involving a cashier’s check.

Security Measures Summary

| Security Measure | Description |

|---|---|

| Advanced Printing Technologies | Microprinting, watermarks, and other sophisticated techniques are employed to deter counterfeiters. |

| Internal Controls | Rigorous internal processes and checks are implemented to ensure authenticity. |

| Record Keeping | Detailed records are maintained to track and trace the issuance and processing of checks. |

| Verification Procedures | Thorough verification procedures are followed to confirm the legitimacy of requests and transactions. |

| Customer Education | Educating customers about common scams and how to identify counterfeit checks is a crucial aspect of fraud prevention. |

Wrap-Up

In conclusion, Bank of Hawaii cashier’s checks offer a secure and reliable payment option, particularly for significant transactions. By understanding their features, verification procedures, and legal implications, you can confidently use them while minimizing potential risks. This guide provides the essential knowledge to make informed decisions and ensure smooth transactions. Remember to prioritize security and be vigilant against fraud.

By diligently following these guidelines, you can use Bank of Hawaii cashier’s checks with confidence and peace of mind.

Question Bank

What are the typical uses of a Bank of Hawaii cashier’s check?

Bank of Hawaii cashier’s checks are commonly used for large purchases, such as real estate transactions, business payments, or when you need a secure payment method that guarantees funds are available.

How do I verify the authenticity of a Bank of Hawaii cashier’s check?

Carefully examine the check for security features, like watermarks and microprinting. Always check the signature and account number on the check against official Bank of Hawaii records.

What are some common scams involving cashier’s checks?

Beware of requests for cashier’s checks to pay for goods or services before receiving them. Be cautious of unsolicited offers or requests for cashier’s checks. Always thoroughly vet the transaction and the party you are dealing with.

What should I do if I suspect a Bank of Hawaii cashier’s check is fraudulent?

Immediately contact the Bank of Hawaii and report the fraudulent check. Do not deposit or cash the check and retain any relevant documentation.