Elective c section insurance coverage – Elective C-section insurance coverage casts a long shadow, a complex web of policy nuances and potential pitfalls. Navigating this intricate landscape demands careful consideration, a deep dive into the procedures, insurance plans, and the often-uncertain financial implications. The journey is fraught with potential hurdles, and this discussion seeks to illuminate the path, however shadowed it may be.

This exploration delves into the complexities of elective C-section insurance coverage, examining various factors that influence insurance decisions. From the medical justifications for the procedure to the patient’s preferences and the potential financial burden, we will unravel the multifaceted nature of this critical topic. Furthermore, we’ll explore the intricacies of the insurance claim process, legal and ethical considerations, and alternative support resources available to those facing these challenging circumstances.

Understanding Insurance Coverage for Elective C-Sections

Elective Cesarean sections, while sometimes necessary for the well-being of both mother and child, are frequently chosen for convenience or other personal reasons. Navigating the complexities of insurance coverage for these procedures is crucial for prospective parents. This section delves into the specifics of elective C-sections, different insurance plan types, and the nuances of coverage across various providers.Elective C-sections, unlike emergency Cesarean deliveries, are planned procedures.

The decision is made in advance, often based on factors such as maternal preference, previous pregnancies, or perceived risks. Understanding the nuances of coverage is vital to avoid financial surprises.

So, elective C-sections. Insurance coverage can be a real pain point, right? It’s all about the details, and sometimes you need to dig deep. Think about how a good men’s cream for face ( men’s cream for face ) can help with the post-baby recovery – a little self-care goes a long way. Ultimately, knowing your insurance policy inside and out is key to getting the coverage you deserve for that elective C-section.

Elective C-Section Procedures, Elective c section insurance coverage

Elective Cesarean sections involve a surgical procedure to deliver a baby through an incision in the mother’s abdomen and uterus. This procedure is performed under anesthesia and typically requires a longer recovery period than vaginal delivery. Pre-operative consultations and assessments are crucial to determine the suitability of the procedure and to ensure the safety of both the mother and the baby.

The complexity of the procedure, the required medical personnel, and the duration of the procedure all play a role in the cost.

Types of Health Insurance Plans and Their Coverage Policies

Health insurance plans vary significantly in their coverage policies. Some plans may cover elective Cesarean sections with minimal or no cost-sharing, while others may require significant out-of-pocket expenses. Understanding the specifics of your plan is crucial to managing potential costs. Factors such as deductibles, co-pays, and coinsurance rates heavily influence the final cost. Furthermore, many plans have varying coverage policies for pre- and post-operative care, as well as for complications that may arise during the procedure.

Comparison of Coverage Across Various Insurance Providers

Insurance providers have varying policies for elective C-sections. Some may consider the procedure medically necessary in certain situations, while others may view it as a non-essential procedure. This difference in interpretation often impacts the coverage provided. Factors like the provider’s network, the surgeon’s credentials, and the hospital’s reputation can influence the final bill. Researching different insurance providers and their policies is crucial to comparing costs and benefits.

Common Exclusions and Limitations Related to Elective C-Sections

| Insurance Plan Type | Coverage for Elective C-section | Exclusions | Limitations |

|---|---|---|---|

| PPO (Preferred Provider Organization) | Generally covers elective C-sections, but cost-sharing may apply. Coverage depends on the specific provider and plan details. | Procedures performed by out-of-network providers may have higher cost-sharing or be excluded. Some PPO plans may impose limitations on the choice of hospitals or physicians. | Deductibles, co-pays, and coinsurance rates can vary widely. Pre-authorization or referrals may be required. |

| HMO (Health Maintenance Organization) | Coverage often depends on the specific plan and provider network. Procedures performed by out-of-network providers may not be covered or may have higher cost-sharing. | Procedures performed outside the HMO’s network are usually not covered. Limited choice of hospitals and physicians. | Stricter restrictions on the choice of healthcare providers and facilities. Cost-sharing may be substantial if the provider or hospital is not in-network. |

| Medicare/Medicaid | Coverage for elective C-sections varies depending on the individual’s specific circumstances. Some plans may require prior authorization or may not cover the procedure at all. | Circumstances and specific conditions may affect the coverage. Out-of-network providers may not be covered. | Limitations on the choice of providers and facilities may apply. Significant cost-sharing is possible. |

Detailed research and communication with your insurance provider are essential to clarify specific coverage details for elective Cesarean sections. Understanding your plan’s terms and conditions is critical to anticipating potential financial responsibilities.

Factors Influencing Insurance Decisions

Navigating the complexities of elective C-section coverage often involves a delicate interplay of medical necessity, patient preferences, and financial implications. Insurance companies carefully evaluate these factors to determine coverage, balancing the need to provide appropriate care with the responsibility to manage costs effectively. Understanding these factors is crucial for both patients and healthcare providers.Elective C-sections, while a safe and sometimes necessary procedure, are not always covered equally by all insurance plans.

The decision hinges on whether the medical justification outweighs the patient’s choice. Different insurance providers may have varying policies, and patients should always consult with their insurance provider and healthcare team to fully understand their coverage options.

Medical Factors Influencing Recommendation

Medical factors often play a pivotal role in a physician’s decision to recommend an elective C-section. These factors can include a history of previous complications during childbirth, concerns about fetal distress, or potential risks associated with vaginal delivery in specific circumstances. For instance, a patient with a prior uterine scar from a previous C-section might be a candidate for an elective C-section to minimize the risk of uterine rupture during a subsequent vaginal delivery.

Similarly, if a baby is positioned transversely (lying sideways) or breech (feet first), an elective C-section might be recommended for optimal delivery.

Patient Preferences and Elective C-Sections

Patient preferences also significantly influence the decision to opt for an elective C-section. While medical necessity remains the primary consideration, a patient’s desire for a scheduled procedure, a preference for a specific delivery date, or concerns about labor pain management can be part of the discussion. However, the insurance company will evaluate if these preferences are supported by legitimate medical factors.

For example, a patient experiencing significant anxiety about childbirth may discuss with their physician the potential benefits of a scheduled C-section.

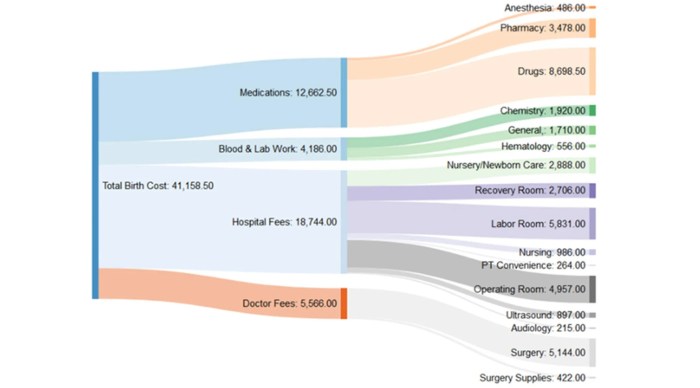

Financial Implications of Elective C-Sections

The financial implications of elective C-sections can vary widely depending on the insurance plan and the specific circumstances. While many insurance plans cover medically necessary C-sections, elective procedures may involve higher out-of-pocket costs. These costs may include deductibles, co-pays, and coinsurance. Furthermore, the cost of anesthesia and other related services might also impact the overall financial burden. For example, if a patient has a high deductible, they could face substantial out-of-pocket expenses.

Impact of Pre-Existing Conditions

Pre-existing conditions can influence insurance coverage for elective C-sections. If a pre-existing condition is directly related to the need for a C-section, the insurance company may be more likely to cover the procedure. However, if the condition is not directly linked to the need for an elective C-section, the insurance company may consider it a non-essential procedure, potentially leading to partial or complete denial of coverage.

For example, a patient with gestational diabetes may have a C-section recommended to manage potential complications. In this case, the condition directly affects the need for the elective C-section.

Potential Legal Implications for Insurance Providers

Insurance providers face potential legal implications when denying coverage for elective C-sections. A denial of coverage must be based on legitimate medical reasons, not arbitrary or discriminatory criteria. If a denial appears to be based on factors unrelated to medical necessity, or if the provider fails to adequately justify their decision, legal action may be possible. For example, if an insurance company denies coverage based on the perceived low risk of vaginal delivery in a healthy patient without a prior history of complications, this could potentially lead to legal challenges.

Navigating the Insurance Claim Process: Elective C Section Insurance Coverage

Successfully navigating the insurance claim process for an elective C-section requires meticulous preparation and a clear understanding of the insurance policy. Knowing your rights and responsibilities, as well as the steps involved, can significantly ease the process and improve the likelihood of a successful claim. This section provides a comprehensive guide to help you through the claim process, from document gathering to appeal procedures.

Claim Filing Steps

Understanding the steps involved in filing a claim for an elective C-section is crucial. A well-organized approach ensures that all necessary information is submitted accurately and promptly. The process generally involves these key steps:

- Review your insurance policy thoroughly. Ensure you understand the specific terms and conditions regarding elective C-sections. This includes coverage limits, co-pays, deductibles, and any pre-authorization requirements.

- Gather all necessary documents. This is paramount for a smooth claim process. Essential documents include your insurance policy, pre-authorization forms (if required), medical records, and any supporting documentation related to the procedure.

- Complete the claim form accurately and completely. Provide all requested information, including the date of the procedure, the surgeon’s details, and the reason for the elective C-section. Ensure the form is submitted promptly to avoid delays.

- Submit the claim electronically or via mail as per your insurance provider’s instructions. Keep a copy of the submitted documents for your records.

- Track the claim status. Regularly check with your insurance provider to monitor the progress of your claim. This allows you to proactively address any issues or questions.

Required Documents

The following documents are typically required for processing an elective C-section claim:

- Insurance policy details: The policy document is critical for verifying coverage and understanding specific terms and conditions.

- Pre-authorization forms (if applicable): These forms must be completed and submitted before the procedure to ensure coverage.

- Medical records: This includes the pre-operative consultation notes, the surgical report, and any other relevant clinical documentation.

- Surgical consent form: This form serves as evidence that the patient consented to the procedure, and that the elective nature of the procedure was documented.

- Billing statements: These details can include the provider’s charges, the amount billed, and any discounts applied.

Common Reasons for Claim Denials

Understanding potential reasons for claim denials is key to proactive problem-solving. A clear understanding of the potential pitfalls can help you avoid them.

- Lack of pre-authorization: If pre-authorization is required, failure to obtain it before the procedure can result in claim denial.

- Incomplete or inaccurate information on the claim form: Any discrepancies or omissions on the form can lead to delays or denial.

- Elective procedure not covered: Some policies may not cover elective procedures, and the claim might be denied based on this.

- Incorrect coding: Using the wrong medical codes for the procedure can lead to denial.

- Failure to meet policy requirements: Ensuring compliance with all policy stipulations is crucial.

Appealing a Denied Claim

An appeal process is designed to rectify issues and address concerns regarding coverage. A well-structured appeal is critical to the success of your claim.

- Review the denial letter thoroughly. This document will Artikel the specific reasons for the denial. Understanding the reasons is critical to the appeal process.

- Gather supporting documentation: Compile any additional evidence that supports your claim and addresses the points of denial. This may include physician letters, medical records, and policy details.

- Prepare a compelling appeal letter: Clearly articulate the reasons for the appeal, emphasizing the specifics of the claim and the rationale for coverage.

- Submit the appeal letter and supporting documents to the insurance provider within the specified timeframe. Maintain a record of your appeal submission.

- Communicate effectively with insurance representatives: Remain professional and polite when communicating with insurance providers. Addressing concerns proactively can be crucial.

Effective Communication with Insurance Providers

Effective communication is vital during the claim process. A clear and concise approach can resolve issues and expedite the process.

- Be clear and concise in your communication. Avoid jargon or ambiguity.

- Be respectful and professional. Maintaining a courteous tone can facilitate positive interaction.

- Document all communication. Record all conversations and correspondences with the insurance provider.

- Follow up on inquiries and requests. Following up promptly can expedite the process.

Claim Appeal Flowchart

This flowchart illustrates the steps involved in appealing a denied elective C-section claim.

[Insert a flowchart image here, with steps like: Review Denial Letter, Gather Supporting Docs, Prepare Appeal Letter, Submit Appeal, Follow Up, and potential resolution options. The flowchart should be easily understandable and visually appealing.]

Legal and Ethical Considerations

Navigating the complex landscape of elective C-section coverage requires a deep understanding of the legal frameworks and ethical considerations at play. Insurance companies, healthcare providers, and patients all have roles and responsibilities in ensuring fair and equitable access to care. This section will delve into the legal underpinnings, ethical dilemmas, and patient rights associated with this sensitive issue.Insurance coverage for elective C-sections is often dictated by state and federal laws, with varying degrees of acceptance.

Some states may have explicit provisions regarding elective procedures, while others may rely on the broader principles of medical necessity. Understanding these nuances is critical to evaluating the legitimacy of insurance claims. A strong legal basis for coverage often rests on a provider’s documentation of medical justification for the elective C-section.

Legal Frameworks Governing Insurance Coverage

Legal frameworks governing elective C-section coverage vary significantly across jurisdictions. Some jurisdictions may mandate coverage for medically necessary procedures, while others may require a demonstrable risk of complications associated with vaginal delivery. These frameworks can influence how insurance companies assess the need for elective C-sections, impacting both the likelihood of approval and the associated costs. For example, a patient with a prior history of difficult vaginal deliveries might have a stronger claim for an elective C-section under a medical necessity argument.

Ethical Considerations Surrounding Coverage

Ethical considerations surrounding elective C-section coverage center on the principles of patient autonomy, beneficence, and non-maleficence. Patient autonomy emphasizes the right of individuals to make decisions about their own bodies, while beneficence dictates that providers act in the best interests of the patient. Non-maleficence requires that interventions minimize harm. The challenge lies in balancing these principles with insurance company considerations of cost-effectiveness and risk management.

Insurance companies often weigh the potential benefits of a planned C-section against the costs of the procedure, potentially leading to ethical dilemmas for healthcare providers and patients.

Patient Rights Regarding Insurance Coverage Decisions

Patients have a right to understand the rationale behind insurance coverage decisions regarding elective C-sections. Transparency in the claim process is crucial, and patients should be informed about the specific criteria used by the insurance company to evaluate the medical necessity of the procedure. Patients also have the right to appeal denied claims and seek legal counsel if necessary.

This process should be transparent and easily accessible to patients, facilitating their understanding of their rights.

Role of Healthcare Providers in Advocating for Patients

Healthcare providers play a vital role in advocating for their patients regarding elective C-section coverage. Thorough documentation of the medical justification for the elective C-section, including potential complications of vaginal delivery, is essential. Open communication between providers and patients about insurance coverage options and the potential implications of a denied claim is paramount. By actively engaging in this process, providers can help patients navigate the complexities of insurance coverage and make informed decisions about their care.

Potential Impact on Maternal Health Outcomes

The availability and accessibility of insurance coverage for elective C-sections can significantly impact maternal health outcomes. Unnecessary vaginal deliveries, potentially leading to complications, can be avoided by elective C-sections, improving the overall well-being of the mother. Limited coverage may lead to delayed or denied procedures, which could negatively impact maternal health. This issue should be addressed in the context of the specific needs of the patient, taking into account both maternal and fetal well-being.

Insurance coverage for elective C-sections should be viewed as a crucial aspect of comprehensive maternal care, contributing to improved health outcomes.

Alternatives and Support Resources

Navigating the financial aspects of an elective C-section can feel daunting, but you’re not alone! This section highlights alternative funding options and vital support resources to help ease your mind and empower you throughout this process. Understanding these avenues can provide a sense of control and confidence in making informed decisions.Many factors can influence the financial burden of an elective C-section, including insurance coverage limitations, out-of-pocket expenses, and unforeseen circumstances.

Fortunately, there are pathways to explore beyond standard insurance coverage, ensuring that your needs are met and your journey toward parenthood remains smooth and supportive.

Alternative Funding Options

Exploring alternative funding options for an elective C-section is crucial for ensuring financial feasibility. These options often come with unique terms and conditions. Carefully review each option’s requirements and associated costs before making a commitment.

- Personal Loans and Savings: Utilizing personal savings or securing a personal loan can help cover the expenses. This approach provides flexibility, but borrowers should carefully consider interest rates, repayment schedules, and potential impact on existing financial commitments. For example, a couple might access a home equity loan if they have a substantial amount of equity built up in their home.

- Crowdfunding Platforms: Online crowdfunding platforms can be a viable option, especially if the financial need is substantial and support from the community is sought. These platforms allow individuals and groups to raise funds from a network of supporters. An expectant parent facing high medical costs could leverage these platforms to reach a wider pool of potential donors. This can be a particularly helpful approach for cases where other funding avenues are limited.

- Family and Friends: Reaching out to family and friends for financial assistance can provide a supportive network. Clear communication regarding the situation and the desired financial help is essential. A written agreement outlining the terms of the assistance, including repayment details, can help maintain a positive and transparent relationship.

Organizations Offering Financial Assistance

Numerous organizations dedicate themselves to providing financial assistance to individuals facing significant medical expenses, including those associated with elective C-sections.

- Nonprofit Hospitals and Healthcare Systems: Many hospitals and healthcare systems operate charitable programs or financial assistance funds. Researching these options can provide valuable resources for eligible individuals. For instance, a specific hospital might have a program tailored to support expectant parents experiencing financial hardship.

- Patient Advocacy Groups: Patient advocacy groups often provide guidance and support to those facing financial challenges related to medical care. These groups may have resources and connections to financial assistance programs. A group focused on maternal health might offer direct referrals to applicable aid organizations.

- Government Programs: Certain government programs, such as Medicaid or the Women, Infants, and Children (WIC) program, may offer financial assistance for medical expenses. Eligibility criteria and requirements vary, so it’s crucial to research specific program details.

Support Groups for Financial Hardship

Finding support groups for individuals facing financial hardship related to elective C-sections can provide emotional support and practical guidance.

- Online Forums and Support Groups: Online forums and support groups can connect individuals with others facing similar financial challenges. Sharing experiences, strategies, and resources can foster a sense of community and mutual support. These groups can provide a valuable network of peers who have walked similar paths.

- Local Community Organizations: Community organizations dedicated to supporting families and individuals facing financial hardship often offer resources and support groups. Local organizations can provide practical advice and resources.

Resources for Understanding Patient Rights and Insurance Processes

Comprehending patient rights and insurance processes is critical for navigating the financial complexities of an elective C-section.

- State and Federal Agencies: State and federal agencies often provide resources on patient rights and insurance claims. These resources can offer guidance on your rights as a patient and your recourse options in cases of insurance disputes. Consult your state’s department of insurance for information on patient rights.

- Patient Rights Organizations: Patient rights organizations offer vital information on patient rights and insurance processes. They can provide valuable insights into navigating insurance claims and understanding your rights. Research organizations focused on maternal healthcare rights.

Locating Legal Counsel for Insurance Disputes

Seeking legal counsel when facing insurance disputes regarding an elective C-section can provide crucial support.

- Legal Aid Organizations: Legal aid organizations provide legal services to individuals who cannot afford private legal representation. They can offer valuable support in navigating insurance disputes and advocating for your rights. Investigate local legal aid organizations specializing in healthcare disputes.

- Medical Malpractice Attorneys: Consult medical malpractice attorneys experienced in insurance disputes. They can assess the merits of your case and represent you in advocating for your rights. Their expertise in healthcare-related legal issues is beneficial.

Illustrative Cases and Scenarios

Elective Cesarean sections, while sometimes medically necessary, often spark debate regarding insurance coverage. Understanding the nuances of these decisions requires examining various scenarios, from approvals to denials and the complexities inherent in the process. This section delves into real-world examples to illustrate these complexities and highlight critical factors.

Insurance Coverage Approval Scenario

A 35-year-old woman, pregnant with her second child, presents with a history of prior Cesarean delivery and a diagnosed condition increasing her risk of complications during vaginal delivery. Her physician, after careful consideration and risk assessment, recommends an elective Cesarean section. The insurance company, upon review of the medical documentation and pre-authorization request, approves the procedure. The pre-authorization process clearly documented the medical necessity, citing the patient’s prior Cesarean delivery and the increased risk of complications during vaginal delivery.

The physician’s detailed justification, emphasizing the potential risks to both mother and child, convinced the insurer.

Insurance Coverage Denial Scenario

A 28-year-old woman, expecting her first child, requests an elective Cesarean section based on a preference for a scheduled delivery. The insurance company denies coverage, citing the absence of medical necessity. The denial letter Artikels the requirement for a demonstrable medical reason, such as a prior Cesarean, a significant obstetric complication, or a diagnosed condition increasing the risk of complications during vaginal delivery.

The insurer highlights that a preference for a scheduled delivery does not constitute a medically necessary reason for an elective Cesarean.

Case Study: The Complexities of Coverage

Sarah, a 32-year-old with a history of gestational diabetes and a previous cesarean section, wishes to schedule her second Cesarean delivery to avoid the potential risks associated with a vaginal delivery. Her insurance provider requires a detailed justification from her physician, demonstrating that a vaginal delivery poses a significantly higher risk than a Cesarean section. The physician’s documentation must include a thorough analysis of Sarah’s medical history, the potential risks of a vaginal delivery, and the expected benefits of a Cesarean delivery.

The insurance company’s decision often hinges on the physician’s ability to articulate a compelling case for medical necessity, which can be a complex process involving medical records review, physician consultations, and potential appeals.

Importance of Pre-Authorization for Elective Cesareans

Pre-authorization is crucial in securing coverage for elective Cesarean sections. A pre-authorization request, submitted in advance, allows the insurance company to review the medical necessity of the procedure. A detailed justification from the physician, supported by medical records and supporting evidence, is essential for successful pre-authorization. Without pre-authorization, the insurance company may deny coverage, leading to financial burdens for the patient.

It’s important to note that the specific criteria for pre-authorization can vary greatly between insurance providers.

So, elective C-sections, insurance coverage can be a real pain point, right? It’s all about what’s considered medically necessary. If you’re looking for a new home, you might want to check out some listings in Fort Madison, Iowa, for instance, homes for sale fort madison iowa. But back to the insurance, it’s often a complex issue, and you need to know your policy inside and out to avoid surprises down the road.

Patient Advocacy in Securing Coverage

A 29-year-old woman, experiencing anxiety about vaginal delivery after a previous traumatic birth experience, needs patient advocacy to secure elective Cesarean section coverage. In cases where the insurance company initially denies coverage based on a lack of perceived medical necessity, a patient advocate can help bridge the gap. Advocates can communicate effectively with the insurance company, providing comprehensive medical documentation and advocating for the patient’s best interests.

Patient advocacy can be particularly valuable when dealing with complex or contentious insurance claims.

End of Discussion

In conclusion, the landscape of elective C-section insurance coverage is a complex terrain. Navigating it requires a thorough understanding of individual insurance policies, medical justifications, and the potential financial and legal implications. This exploration has illuminated the intricacies of this topic, offering insights into the claim process, ethical considerations, and resources available to those needing support. Ultimately, the journey through this shadowy path hinges on informed decisions, careful planning, and potentially, seeking professional guidance.

FAQ Summary

What factors might influence a doctor’s decision to recommend an elective C-section?

Medical factors such as the mother’s or baby’s health, previous pregnancies, or complications during labor may influence the decision. The specific health conditions and risks of each individual case will be considered.

What are common reasons for claim denials regarding elective C-sections?

Common reasons for denial include a lack of medical necessity, pre-existing conditions not properly documented, or failure to comply with pre-authorization requirements. Understanding these reasons can help in developing a stronger appeal.

What are some alternative funding options for elective C-sections?

Alternative funding options may include fundraising campaigns, personal loans, or financial assistance programs from healthcare organizations or charities. These options can be explored alongside insurance coverage avenues.

What rights do patients have regarding insurance coverage decisions for elective C-sections?

Patients have the right to understand their insurance policy details, appeal denials, and seek legal counsel if needed. Knowledge of these rights is essential in navigating the complexities of the process.