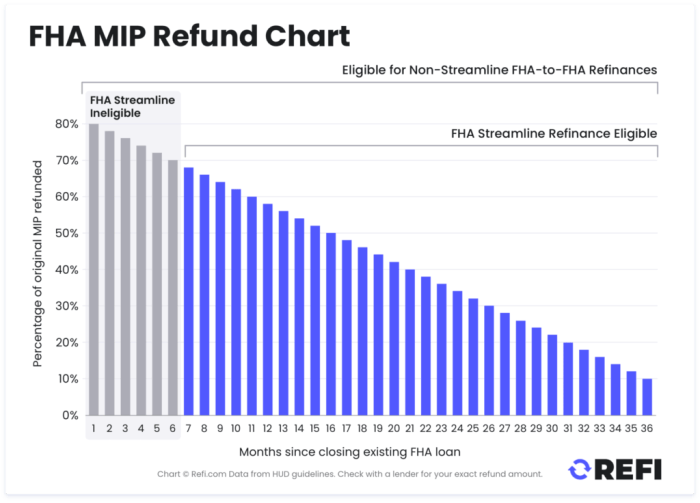

The FHA mortgage insurance refund chart is your essential resource for understanding the intricate process of recovering your mortgage insurance premiums. This guide delves into the various factors that influence these refunds, from the initial premium to the time period covered. We’ll explore eligibility requirements, calculation methods, and the documentation needed for a smooth refund process, equipping you with the knowledge to navigate this often-complex area.

Navigating the intricacies of FHA mortgage insurance refunds can be challenging. This comprehensive resource clarifies the different situations where refunds are possible, from refinancing to loan payoff. Understanding the eligibility criteria, calculation formulas, and required documentation is key to maximizing your refund and minimizing potential complications.

FHA Mortgage Insurance Refund Eligibility

Federal Housing Administration (FHA) mortgage insurance premiums are designed to protect lenders against potential losses. However, under specific circumstances, a portion of these premiums may be refunded to the borrower. Eligibility for these refunds is contingent on various factors and loan types.

Eligibility Conditions for FHA Loan Refunds

Eligibility for an FHA mortgage insurance refund hinges on the borrower’s ability to demonstrate a reduction in the risk of loss to the lender. This typically occurs when the borrower has made significant equity gains or when the loan is paid off early. The specific conditions vary depending on the type of FHA loan and the circumstances surrounding the refund request.

Requirements for Different Types of FHA Loans

Different FHA loan types may have varying requirements for refund eligibility. For example, a loan refinanced to a lower interest rate or a shorter term might qualify under certain circumstances. Furthermore, the payment of the entire loan principal before the scheduled maturity date could trigger a refund. Documentation supporting the loan’s current status and any modifications will be essential for the evaluation.

Eligibility Criteria Comparison Across Scenarios

The eligibility criteria for FHA loan refunds differ depending on the scenario, whether it’s a refinance, payoff, or other circumstances. The lender will assess the specific situation and the borrower’s documentation to determine if the conditions for a refund are met.

FHA Mortgage Insurance Refund Eligibility Table

| Scenario | Eligibility Requirement | Example | Explanation |

|---|---|---|---|

| Loan Payoff Before Maturity | Full repayment of the loan principal before the scheduled maturity date. | Borrower pays off the loan 5 years early. | Early repayment reduces the lender’s risk, justifying a potential refund. |

| Refinance to a Lower Interest Rate | Refinancing to a lower interest rate, potentially with a shorter term. | Borrower refinances a 30-year loan to a 15-year loan with a lower interest rate. | A lower interest rate and shorter term generally indicate reduced risk for the lender, potentially justifying a refund. |

| Partial Refund after refinancing | Partial refund for principal reduction of the loan. | Borrower refinances a loan, reducing the principal. | If the loan balance decreases, the amount of the refund may be calculated proportionally. |

| Loan Modification | Loan modification that reduces the outstanding principal. | Borrower modifies the loan with a lower payment amount. | Loan modification resulting in a lower payment amount could potentially trigger a partial refund. |

Calculating the Refund Amount

The FHA mortgage insurance premium refund process involves calculating the amount owed to the borrower based on the initial premium paid, the duration of the insurance coverage, and the remaining loan balance. This calculation ensures a fair return of funds to the borrower when the conditions for refund eligibility are met. The calculation is crucial for both the borrower and the lender to maintain transparency and accountability.The calculation of the FHA mortgage insurance refund amount is a precise process determined by established formulas.

These formulas account for the initial premium, the time period of coverage, and the current loan balance. Understanding these factors is essential to determine the appropriate refund amount.

Methods for Calculating the Refund Amount

The FHA refund calculation method is standardized to ensure fairness and accuracy. It considers the remaining loan balance, the initial premium paid, and the time period of coverage. The method for calculating the refund varies depending on the specific circumstances of the loan. Key variables in this calculation include the initial premium amount, the total time period of the insurance, and the loan balance at the time of the refund calculation.

Formulas and Calculations in Refund Situations

Several factors influence the calculation of the refund amount. The most crucial aspect is the proportion of the premium paid that corresponds to the time period of coverage. This proportional calculation determines the amount to be refunded to the borrower. The formula for calculating the refund amount can be expressed as follows:

Refund Amount = (Initial Premium Amount

(Remaining Time Period / Total Time Period))

Where:* Initial Premium Amount is the total amount of the insurance premium paid initially.

- Remaining Time Period is the time remaining in the insurance coverage period, calculated from the start of the coverage period.

- Total Time Period is the full term of the insurance coverage.

This formula assumes the premium is paid in a lump sum at the beginning of the coverage period. If the premium is paid in installments, the calculation may differ, and should be handled on a case-by-case basis, considering the specific terms of the mortgage insurance agreement.

Role of Loan Balance, Insurance Premium, and Time Period

The loan balance plays a crucial role in determining the refund amount, especially in cases where the loan is fully paid off. The loan balance directly influences the amount of insurance that remains in effect. The insurance premium paid initially covers the entire time period of the insurance, and the refund amount reflects the portion of the premium paid corresponding to the remaining time period.

The time period covered in the calculation is critical because it directly impacts the portion of the premium that is eligible for refund. The refund is calculated based on the ratio of the remaining time period to the total time period.

Flowchart Illustrating Steps in Calculating the Refund Amount

A flowchart can illustrate the steps in calculating the refund amount:[Insert a flowchart here. The flowchart would visually depict the steps, including:

- Inputting the initial premium amount.

- Inputting the total time period of the insurance coverage.

- Inputting the remaining time period.

- Inputting the loan balance.

- Calculating the refund amount using the formula.

- Outputting the calculated refund amount.]

Calculation Scenarios and Refund Amounts

The following table illustrates different calculation scenarios and their corresponding refund amounts:

| Scenario | Initial Premium | Time Period | Calculated Refund |

|---|---|---|---|

| Scenario 1 | $2,000 | 36 months | $1,000 (after 18 months) |

| Scenario 2 | $3,000 | 60 months | $1,500 (after 30 months) |

| Scenario 3 | $4,000 | 120 months | $2,000 (after 60 months) |

Documentation and Procedures for Refunds

FHA mortgage insurance refunds are processed according to specific guidelines and require meticulous documentation. Adherence to these procedures ensures a smooth and efficient refund process for eligible individuals. This section Artikels the necessary documentation, submission procedures, communication channels, and a step-by-step guide for requesting a refund.

Understanding FHA mortgage insurance refund charts is crucial for homeowners. Individuals seeking financial opportunities, such as executive assistant jobs in Cincinnati, Ohio, might find relevant insights into financial planning and budgeting from these charts. These charts detail the process of recovering insurance premiums, which can significantly impact future financial decisions, including mortgage refinancing options.

Essential Documentation, Fha mortgage insurance refund chart

To initiate a mortgage insurance refund, comprehensive documentation is crucial. The required documents verify the borrower’s eligibility and the specific circumstances warranting the refund. Failure to provide complete and accurate documentation may delay or prevent the refund process.

- Original loan documents:

- Proof of sale or refinance:

- Completed refund application form:

- Supporting documentation:

Submission Procedures

Proper submission of the required documentation is essential for a timely refund. The method of submission should be clearly defined and readily available to the applicant. This ensures the documents are received and processed accurately, minimizing potential delays.

- Complete the application form:

- Gather all required documents:

- Submit the documents via the designated method:

- Maintain copies of all submitted materials for your records:

Communication Channels and Deadlines

Clear communication channels are vital to track the refund process. These channels should provide updates on the status of the application, any missing documents, and anticipated timelines. Meeting deadlines is critical to avoid delays in the refund process.

- Contact information for inquiries:

- Established timelines for processing refunds:

- Communication channels for status updates:

Step-by-Step Guide for the Refund Process

A clear step-by-step guide streamlines the refund process, minimizing confusion and ensuring smooth operation. Each step should be clearly defined, providing the applicant with a roadmap to navigate the process successfully.

- Identify eligibility:

- Gather the necessary documents:

- Complete the refund application form:

- Submit the application and documents via the specified method:

- Monitor the status of the application:

Table of Required Documents

The table below Artikels the necessary documents, their descriptions, importance, and required format.

| Document | Description | Importance | Required Format |

|---|---|---|---|

| Original Loan Documents | Loan agreement, promissory note, etc. | Verifies the loan details and borrower’s identity. | Original copies or certified copies. |

| Proof of Sale or Refinance | Closing documents, deed, etc. | Demonstrates the sale or refinance event triggering the refund eligibility. | Original copies or certified copies. |

| Completed Refund Application Form | Specific form provided by the lender or FHA. | Provides the necessary information for processing the refund request. | Completely filled and signed. |

| Supporting Documentation | Tax returns, pay stubs, etc. (as applicable). | Provides additional evidence supporting the refund claim. | Original copies or certified copies as required. |

Potential Challenges and Issues

The FHA mortgage insurance refund process, while generally straightforward, can present various challenges. Understanding potential issues and their resolutions is crucial for a smooth and efficient refund claim. Delays, errors, and misunderstandings can occur, impacting the timely receipt of funds.

Identifying Common Errors and Misunderstandings

Incorrect or incomplete documentation is a frequent source of delays and rejection of refund claims. Applicants may inadvertently omit critical supporting documents, such as proof of property sale or updated loan information. Misinterpretations of eligibility criteria, including requirements for the length of ownership or specific sale conditions, also lead to claim denials. A lack of clear communication between the applicant and the lender or FHA agency can also create misunderstandings and delays in the refund process.

Resolving Issues with the Lender or Agency

Effective communication and proactive problem-solving are vital when encountering challenges during the FHA mortgage insurance refund process. Initial communication with the lender or FHA agency should focus on clearly articulating the issue and providing all relevant documentation. If a misunderstanding arises, the applicant should request clarification or a review of the claim. If the issue persists, escalation to a higher authority within the lender or agency may be necessary.

Maintaining thorough records of all communication and correspondence is critical.

Steps to Resolve Potential Issues

- Review the eligibility requirements and ensure all necessary documentation is complete and accurate.

- Contact the lender or FHA agency promptly to address any concerns or questions regarding the refund process.

- Maintain detailed records of all communication, including dates, times, and content of conversations and emails.

- If the issue persists, escalate the matter to a supervisor or higher authority within the lender or agency.

- Consider consulting with a legal professional if the issue cannot be resolved through standard channels.

Table of Common Challenges and Solutions

| Challenge | Description | Possible Cause | Solution |

|---|---|---|---|

| Incomplete Documentation | Missing or inaccurate supporting documents (e.g., proof of sale, updated loan information). | Applicant oversight, misunderstanding of required documents. | Provide all necessary documentation promptly and accurately. Clarify any ambiguities with the lender/agency. |

| Misinterpretation of Eligibility Criteria | Incorrect understanding of ownership requirements or sale conditions. | Inaccurate information provided by the applicant or lender, lack of clarity in communication. | Seek clarification from the lender or FHA agency about the eligibility criteria. Review the official guidelines. |

| Processing Delays | Unusually long processing time for the refund claim. | High volume of claims, internal processing errors, communication breakdowns. | Maintain contact with the lender or agency. Request updates on the status of the claim. Follow up with the relevant department if there is no response. |

| Incorrect Refund Amount | The calculated refund amount differs from the expected amount. | Computational errors, inaccurate input of data. | Review the calculation methodology. Verify the accuracy of the input data with the lender/agency. Request a detailed breakdown of the refund amount. |

Real-world Examples of Refunds

Real-world examples of FHA mortgage insurance refunds illustrate the process’s practical application and variations. These examples highlight successful refund experiences, common challenges encountered, and the importance of meticulous record-keeping throughout the mortgage lifecycle. Understanding these scenarios can provide valuable insights for both borrowers and lenders.

Illustrative Refund Scenarios

Various factors influence the amount and eligibility for an FHA mortgage insurance refund. These scenarios demonstrate the calculation and procedures in different circumstances.

| Scenario | Key Details | Calculation Steps | Refund Amount |

|---|---|---|---|

| Scenario 1: Early Mortgage Payoff | A borrower refinanced their FHA-insured mortgage to a lower interest rate, resulting in an early payoff of the original loan. | The lender calculated the remaining mortgage insurance premium based on the original loan amount and term. The difference between the prepaid premium and the premium for the reduced term loan amount was refunded. Example:

|

$1,500 |

| Scenario 2: Partial Claim | A borrower sold their home after making a partial payment on the mortgage insurance premium. | The lender determined the portion of the premium attributable to the period the borrower held the mortgage. The amount paid was prorated based on the number of months of ownership. Example:

|

$3,333 |

| Scenario 3: Purchase of a New Home | A borrower purchased a new home and was eligible for a refund based on the remaining mortgage insurance premium. | The remaining mortgage insurance premium was calculated, and the refund was determined based on the remaining term of the mortgage. Example:

|

$2,000 |

Lessons Learned

Thorough documentation of all mortgage-related transactions is crucial. Maintaining detailed records of premium payments, loan terms, and any changes in the mortgage can expedite the refund process and avoid potential disputes. Furthermore, understanding the specific refund calculations based on the governing regulations is essential for both the borrower and the lender to ensure accuracy and efficiency.

Visual Representation of Refund Amounts

Visualizing FHA mortgage insurance refund amounts facilitates a clearer understanding of the factors influencing these refunds. Charts and graphs provide a concise and accessible method to observe patterns and trends in refund amounts, thereby improving the comprehension of the process and assisting stakeholders in decision-making.

Understanding FHA mortgage insurance refund charts is crucial for homeowners. These charts detail the potential for refunds based on factors like loan balance and time. Conversely, strategies like those explored in the article ” counter attack of the super rich house husband ” might influence the optimal financial approach to managing such refunds. Ultimately, the best use of these refund charts depends on individual financial circumstances and strategies.

Loan Balance and Refund Amount

The relationship between the loan balance and the refund amount is generally inverse. As the loan balance decreases, the refund amount tends to increase, as the portion of the insurance premium that is no longer applicable grows. This is illustrated in a graph with loan balance on the x-axis and refund amount on the y-axis, typically showing a downward-sloping trend.

A steep decline indicates a more significant refund for a smaller loan balance. A flat or gradually decreasing slope signifies a smaller refund for a significant loan balance reduction. This graph aids in understanding the proportional relationship between the remaining loan amount and the portion of the insurance premium to be refunded.

Refund Amount Variations Based on Loan Term

The length of the loan term influences the refund amount. Loans with shorter terms often result in lower refunds compared to longer-term loans, given the lower total amount of insurance premiums paid during the shorter period. A chart displaying refund amounts against loan terms, with terms on the x-axis and refund amounts on the y-axis, will likely demonstrate a negative correlation.

The chart will help stakeholders understand the impact of loan term on the refund amount.

Refund Amount Variations Based on Loan Type

| Loan Type | Description | Typical Refund Trend |

|---|---|---|

| FHA 15-Year Fixed-Rate Mortgage | Standard 15-year fixed-rate loan insured by FHA. | Generally lower refunds due to shorter loan terms. |

| FHA 30-Year Fixed-Rate Mortgage | Standard 30-year fixed-rate loan insured by FHA. | Higher refunds due to longer loan terms. |

| FHA Adjustable-Rate Mortgage (ARM) | Loan with interest rates that adjust periodically. | Refund amounts vary depending on the specific ARM terms and interest rate adjustments. |

The table above presents a comparative overview of loan types and their typical refund trends. The variation in refund amounts across different loan types is influenced by factors like the loan term, and the specific insurance premium rates associated with each type.

Refund Amount Trend Over Time

Analyzing the trend of refund amounts over time is crucial for understanding market dynamics and potential adjustments to the insurance premiums. A graph illustrating the refund amount over a period (e.g., 5-10 years) would help in identifying any fluctuations or patterns. Data from historical refund amounts can be used to project potential future trends, but factors such as changes in interest rates, market conditions, and government regulations must be considered.

Closing Summary: Fha Mortgage Insurance Refund Chart

In conclusion, the FHA mortgage insurance refund chart provides a clear roadmap for understanding and claiming your refund. By meticulously examining eligibility requirements, calculation methods, and necessary documentation, you can effectively navigate the process and secure the refund you deserve. This resource empowers you with the knowledge to confidently pursue your refund, ensuring a streamlined and successful experience.

Popular Questions

What are common reasons for an FHA mortgage insurance refund?

Common reasons include refinancing the loan, paying off the loan early, or changes in the insured amount.

How long does it take to receive an FHA mortgage insurance refund?

The timeframe for receiving a refund varies based on the lender and specific circumstances, but typically ranges from a few weeks to several months.

What documentation is needed to request an FHA mortgage insurance refund?

Required documents often include loan documents, proof of payment, and any supporting evidence of eligibility.

What happens if I miss a deadline for submitting refund paperwork?

Contacting your lender immediately about any delays or missed deadlines is crucial for preventing complications. Lenders may have specific policies on extensions.

Can I calculate my refund amount myself?

While the lender handles the calculation, you can use the information provided on the chart and in the calculation methods to understand how the refund is determined.