Vermont routing number TD Bank: Navigating the world of financial transactions requires understanding specific routing numbers. This comprehensive guide will walk you through the specifics of Vermont routing numbers for TD Bank, ensuring your financial transactions are executed smoothly and securely.

From understanding the fundamental role of routing numbers in various financial transactions to discovering practical methods for finding your TD Bank routing number, this resource provides a clear and concise overview. Learn about common issues, troubleshooting steps, and security considerations to ensure your transactions are processed accurately and safely.

Understanding TD Bank Routing Numbers in Vermont: Vermont Routing Number Td Bank

TD Bank routing numbers are crucial for financial transactions in Vermont, ensuring funds reach the correct accounts. These numbers act as unique identifiers for the bank’s processing centers, facilitating smooth and secure electronic transfers. Understanding their structure and function is essential for anyone handling or receiving money from a TD Bank account in the Green Mountain State.

Routing Number Significance

Routing numbers are essential components of financial transactions. They direct funds to the correct bank and processing center, preventing errors and ensuring timely delivery. Without accurate routing numbers, transactions can be delayed, rejected, or misrouted, leading to financial complications. This is critical for both individual and business transactions. Routing numbers are specific to each bank and are not interchangeable.

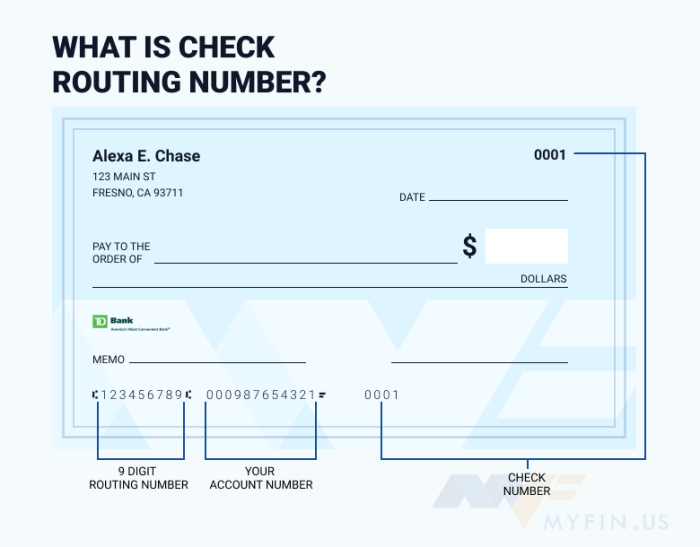

Routing Number vs. Account Number

Routing numbers and account numbers serve distinct purposes. Routing numbers identify the bank or financial institution, while account numbers identify the specific deposit or checking account. Think of the routing number as the address of the bank, and the account number as the address of the specific account within that bank. This distinction is fundamental for secure and efficient transactions.

Vermont TD Bank Routing Number Format

TD Bank routing numbers in Vermont, like routing numbers nationwide, adhere to a standardized format. The format typically consists of nine digits. A common example of a TD Bank routing number in Vermont is 021000010. This format ensures uniformity and facilitates the processing of transactions across different systems.

Role in Electronic Funds Transfers

Routing numbers are critical in electronic funds transfers. When you send or receive money electronically, the routing number ensures the funds are sent to the correct bank’s processing center for onward transfer to the recipient’s account. This process relies on accurate routing information for seamless transactions. In the case of an error, funds may be delayed or not processed.

Comparison of Vermont Bank Routing Numbers (Example)

| Bank | Routing Number |

|---|---|

| TD Bank | 021000010 |

| Capital One | 341000001 |

| KeyBank | 051000034 |

Note: This is a sample table and does not include all Vermont banks. Routing numbers can change, so it is crucial to check with the bank directly for the most up-to-date information.

Finding TD Bank Routing Numbers in Vermont

TD Bank routing numbers are crucial for transferring funds and making payments. Knowing the correct routing number ensures your transactions reach the intended destination efficiently and accurately. This guide provides comprehensive methods for finding your TD Bank routing number in Vermont.Vermont residents can utilize various methods to locate their TD Bank routing numbers, ensuring seamless financial transactions. This information is designed to help you avoid potential errors and delays in your financial activities.

Common Methods for Locating TD Bank Routing Numbers

TD Bank routing numbers are readily available through multiple channels. Understanding these methods can save you time and effort in managing your financial transactions.

- Online Resources: TD Bank’s website offers a dedicated section for finding routing numbers. This section often includes FAQs, online forms, and other helpful information.

- Customer Service Channels: TD Bank’s customer service representatives can provide immediate access to routing numbers. Contacting customer service through phone or online chat allows for quick and efficient assistance.

- Physical Branches: TD Bank branches in Vermont serve as convenient locations to obtain routing numbers. Visiting a branch allows for face-to-face interaction and immediate resolution of any inquiries.

Online Resources for Routing Number Lookups

TD Bank’s website provides various online resources to locate routing numbers. This section details accessible online resources for routing number lookups.

| Resource | Description |

|---|---|

| TD Bank Website | The official TD Bank website is a primary source for routing numbers. It often includes dedicated sections or FAQs with routing number information. |

| TD Bank Mobile App | TD Bank’s mobile app provides convenient access to account information, including routing numbers. This app simplifies routing number retrieval through a user-friendly interface. |

| Online Account Access | TD Bank online banking platforms allow access to account details, including routing numbers, through secure logins. |

Obtaining Routing Numbers Through Customer Service

TD Bank’s customer service channels provide efficient methods for retrieving routing numbers. These channels facilitate quick access to the needed information.

- Phone: Contacting TD Bank’s customer service line allows for direct assistance in retrieving routing numbers. Representatives can provide immediate solutions to inquiries.

- Online Chat: TD Bank’s online chat service allows for real-time interaction with customer service representatives. This option provides prompt support in obtaining routing numbers.

Locating Routing Numbers at Physical Branches

TD Bank’s physical branches in Vermont offer convenient access to routing numbers. These branches facilitate in-person assistance for inquiries.

- Visit a Branch: Visiting a TD Bank branch in Vermont provides a direct way to obtain your routing number. Experienced staff can provide assistance immediately.

Step-by-Step Guide for Finding a TD Bank Routing Number

This step-by-step guide provides a clear path to locating your TD Bank routing number.

- Access TD Bank’s Website: Begin by navigating to the official TD Bank website.

- Locate Routing Number Section: Identify the dedicated section on the website that contains routing number information.

- Enter Account Information: Input the required account details for accurate routing number retrieval.

- Review and Confirm: Verify the displayed routing number to ensure accuracy before proceeding.

Using TD Bank Routing Numbers in Vermont

TD Bank routing numbers are crucial for ensuring your Vermont-based transactions are processed correctly. Knowing how to use them accurately for online transfers, check deposits, and withdrawals is essential to avoid delays or errors. Proper use minimizes the risk of funds being lost or misdirected.Accurate use of TD Bank routing numbers in Vermont is vital for the smooth and reliable execution of financial transactions.

Whether sending money online or processing checks, understanding the correct application of these numbers safeguards your financial interests and ensures transactions are processed efficiently.

The Vermont routing number for TD Bank is crucial for domestic transactions. However, for international or offshore financial activities, understanding accounts like the standard bank offshore seafarers account becomes increasingly important. This type of specialized account, designed for seafarers, often necessitates alternative routing numbers and payment procedures, highlighting the diversity of financial needs and the corresponding complexity of international banking.

Ultimately, the correct Vermont routing number for TD Bank remains essential for domestic transactions.

Online Transfers

Correctly entering the routing number is critical for online transfers. It directs the funds to the correct account. Using the wrong routing number can lead to the transfer failing or reaching an incorrect account. Ensure the number is entered precisely as displayed on your TD Bank statement.

Check Deposits and Withdrawals

Routing numbers are essential for check deposits and withdrawals. They ensure the check is credited or debited to the correct account. Errors in the routing number can result in the check being rejected or processed to the wrong account. Double-checking the routing number on your check against your TD Bank statement is crucial.

Examples of Transaction Use

Consider transferring \$500 from your savings account to your checking account. You would enter the routing number associated with your checking account. Similarly, depositing a check requires entering the routing number linked to your account to ensure the funds are deposited correctly. For withdrawals, the routing number is vital for linking the withdrawal to your account.

Importance of Accuracy

Accuracy is paramount when entering routing numbers. Even a single digit error can lead to severe issues. Incorrect routing numbers can result in delayed transactions, failed transfers, and lost funds. Use a reliable source like your TD Bank statement to verify the routing number.

Routing Number Format Table

| Transaction Type | Routing Number Format Example |

|---|---|

| Online Transfer | 021000024 |

| Check Deposit | 021000024 |

| Check Withdrawal | 021000024 |

Potential Risks of Incorrect Routing Number Use

Using the wrong routing number can result in financial losses. For instance, an incorrect routing number could lead to the transfer of funds to an unintended account, causing financial trouble for you. Furthermore, delays in processing can also lead to financial issues if deadlines are missed. Using the correct routing number is essential for avoiding these problems.

While researching Vermont routing numbers for TD Bank, relevant information about financial regulations often intersects with other areas of law. For example, understanding the necessity of motorcycle insurance in Texas, as detailed in this resource is motorcycle insurance required in texas , can offer insights into state-specific financial responsibilities. This understanding, however, ultimately does not directly impact the required routing number for TD Bank in Vermont.

Common Issues and Solutions

TD Bank routing numbers are crucial for seamless Vermont transactions. Mistakes can lead to delays or failed transfers. Understanding common problems and solutions can save you time and frustration. This thread will detail potential issues and how to address them.Vermont residents rely on TD Bank for various financial needs. Knowing how to use the correct routing number is essential for smooth transactions.

This thread will highlight potential problems, common mistakes, and troubleshooting steps for accurate routing number entry.

Common Routing Number Errors

Incorrect routing numbers are a frequent source of transaction failures. A single digit error can halt a payment. Data entry errors, using the wrong format, or selecting the wrong routing number for the desired account are common pitfalls.

- Incorrect Format: Using an incorrect format, such as adding spaces or hyphens where they shouldn’t be, or omitting essential digits, leads to rejected transactions. Ensure the number adheres to the standardized format for Vermont TD Bank accounts.

- Wrong Routing Number: Selecting the wrong routing number for the intended TD Bank account in Vermont can cause transfers to fail or reach the wrong recipient. Verify the routing number against the correct account information.

- Typos: Simple typos in the routing number can halt the transfer process. Double-check for any errors during data entry. Using a trusted source for the routing number is essential to avoid typos.

Troubleshooting Transaction Failures

When a transaction fails, careful analysis is required to identify the root cause. Reviewing the error messages and confirming the routing number against official sources is essential.

- Verify the Routing Number: Double-check the routing number against the TD Bank account details. Use the TD Bank website or a trusted source for accurate verification.

- Check Account Details: Ensure all account details, including the account number and routing number, are accurate. Verify that the account is active and not flagged for any restrictions.

- Review the Transfer Instructions: Verify that the transfer instructions match the requirements. Pay close attention to any specific instructions or guidelines.

- Contact TD Bank: If the issue persists, contact TD Bank customer service for assistance. They can help diagnose the problem and provide guidance.

Frequently Asked Questions (FAQs)

- How do I find my TD Bank routing number in Vermont? You can locate your TD Bank routing number on your account statements, online banking portal, or by contacting TD Bank customer service.

- What are the consequences of using an incorrect routing number? Using an incorrect routing number can lead to delayed or failed transactions, potentially causing financial inconvenience.

- How can I avoid mistakes when entering the routing number? Double-check the routing number against a reliable source before entering it, and verify the format adheres to standards.

Error Summary Table, Vermont routing number td bank

| Error | Solution |

|---|---|

| Incorrect Routing Number Format | Verify the format against official TD Bank guidelines or your account statement. |

| Incorrect Routing Number | Use the official TD Bank website, app, or contact customer service to retrieve the correct routing number. |

| Typos in Routing Number | Double-check for typos during data entry and re-enter the number from a trusted source. |

Illustrative Examples and Case Studies

TD Bank routing numbers are crucial for seamless electronic transactions in Vermont. Understanding how these numbers function in various scenarios, from successful transfers to troubleshooting errors, is vital for a smooth banking experience. Let’s explore some real-world examples.

Successful Electronic Fund Transfers

Vermont residents rely on electronic transfers for convenience and speed. Successful transfers hinge on accurate routing numbers. For instance, a Vermont resident transferring funds from their TD Bank account to a friend’s account at a different Vermont bank using online banking will require the correct routing number to ensure the funds reach the intended recipient without delay. A successful transfer will reflect in both accounts within the expected timeframe, confirming the accuracy of the routing number.

Check Deposit Processes

Check deposits, while often a slower process than electronic transfers, also require accurate routing numbers. When depositing a check at a TD Bank branch in Vermont, the routing number of the recipient’s account is crucial for the deposit to be processed accurately and reflected in the recipient’s account. The correct routing number ensures the funds are transferred from the payer’s account to the recipient’s account through the appropriate channels, preventing delays and errors.

Incorrect routing numbers can lead to delays in the check clearing process.

Errors Related to Incorrect Routing Numbers

Incorrect routing numbers can lead to significant issues. For example, a customer depositing a check into their TD Bank account in Vermont using an incorrect routing number might find the funds do not appear in the intended account. This can result in delays in receiving payments or the need to initiate a dispute with the bank. This illustrates the importance of double-checking the routing number for all transactions.

Case Studies of Common Problems and Solutions

A common problem is using the wrong routing number for a different bank. A solution is to carefully verify the routing number from the recipient’s bank documents or their online banking portal. Another common problem is a typo in the routing number. The solution is to meticulously re-enter the routing number, ensuring each digit is accurate. These simple steps can prevent costly errors and delays.

Illustrative Table of Scenarios

| Scenario | Problem | Solution | Outcome |

|---|---|---|---|

| Electronic Funds Transfer (EFT) | Incorrect Routing Number | Verify routing number from recipient’s bank documents | Funds not transferred to recipient’s account. |

| Check Deposit | Typos in Routing Number | Double-check routing number from recipient’s bank documents. | Check deposit delayed or rejected |

| International Transfer | Incorrect Routing Number Format | Use the correct format for international routing numbers. | Transfer failed or delayed |

Security Considerations for Routing Numbers

Routing numbers, vital for transferring funds, are susceptible to fraud if not handled with care. Understanding the security measures surrounding these numbers is crucial for protecting your financial transactions. Protecting your routing number from unauthorized access is a key aspect of responsible financial management.

Protecting Your Routing Number

Protecting your routing number from unauthorized access is a multifaceted approach. A crucial aspect is to never share your routing number with anyone unless you’ve initiated the transaction and know the recipient. Be wary of unsolicited requests for this information. Never share your routing number via email, text, or any unsolicited communication. Store your routing number securely, preferably in a password-protected document or a secure digital vault.

Furthermore, ensure that your financial accounts and online banking platforms have robust security measures in place.

Safe Practices for Online Transactions

Safe online transactions involving routing numbers require careful attention to detail. Verify the legitimacy of the recipient’s website or application before entering your routing number. Look for secure connection indicators (HTTPS) and verify the company’s reputation. Use strong passwords and enable multi-factor authentication whenever possible for added security layers. Avoid using public Wi-Fi networks for sensitive financial transactions as they are susceptible to interception.

Regularly monitor your account activity for any suspicious transactions.

Verifying Routing Number Authenticity

Verifying the authenticity of a routing number is paramount to prevent fraud. Always cross-reference the routing number with official records. The Federal Reserve website provides a tool to validate routing numbers. Employing this method can confirm that the routing number is genuine. This verification process helps mitigate the risk of fraudulent activities.

Fraud Prevention Related to Routing Numbers

Fraud prevention related to routing numbers involves a proactive approach. Report any suspicious activity immediately to your bank or financial institution. If you suspect a fraudulent transaction, contact your bank or financial institution immediately. By implementing these security measures, you significantly reduce the risk of unauthorized access or fraudulent activity involving your routing number.

Security Measures Summary

| Security Measure | Description |

|---|---|

| Never share routing numbers with unknown parties | Refrain from sharing routing numbers with entities you haven’t initiated a transaction with. |

| Secure storage | Store routing numbers in secure digital vaults or password-protected documents. |

| Verify recipient legitimacy | Thoroughly verify the legitimacy of websites or applications before entering your routing number. |

| Use strong passwords and multi-factor authentication | Utilize strong passwords and enable multi-factor authentication for added security. |

| Avoid public Wi-Fi | Refrain from using public Wi-Fi for sensitive financial transactions. |

| Monitor account activity | Regularly monitor your account activity for suspicious transactions. |

| Verify routing number authenticity | Use official resources to verify routing number legitimacy. |

| Report suspicious activity | Immediately report any suspicious activity to your financial institution. |

Last Point

In conclusion, understanding Vermont routing numbers for TD Bank is crucial for seamless financial transactions. This guide has provided a comprehensive overview, covering everything from basic concepts to practical application. By mastering these essential details, you can confidently navigate the complexities of electronic transfers, check deposits, and withdrawals, all while prioritizing security and accuracy.

Frequently Asked Questions

What is the format of a TD Bank routing number in Vermont?

TD Bank routing numbers in Vermont follow a standard nine-digit format, crucial for accurate processing of transactions.

How can I find my TD Bank routing number online?

TD Bank’s website offers various methods for locating your routing number, often through account access or customer support portals.

What are the potential risks of entering an incorrect routing number?

Entering an incorrect routing number can lead to delayed or failed transactions, potentially causing financial issues. Double-checking your information is essential.

What should I do if I encounter a transaction failure due to a routing number issue?

If you encounter a transaction failure, consult TD Bank’s support channels or review the transaction details for any clues regarding the error.